Hey, the market started off pretty good for the week. Up 62 pts or so. The market reporters said that the market was up because of some good news out on the wire. I guess I am surprised that the market did not do better today. We need help from the institutions if this market is gonna do anything.

- A better than expected 60-75% Iraqi voter turnout that passed without a considerable increase in violence

- OPEC's decision to maintain its current rate of oil production at 27 mln barrels a day

- Homebuilding had been weak following Dec New Home Sales that came in slightly below forecasts (1.09 mln units versus consensus of 1.2 mln),

- Jan Chicago PMI, which showed Midwest manufacturing activity expanded for the 21st consecutive month with a better than expected read of 62.4 (consensus 59.8)

The market needs a lot more good news for it to push forward. Remember, back in the day when a company could say that they did not lose as much as they thought and the stock went up about 40%. How about when an Internet company said they were going to have an increase in "page impressions" or "eyeball traffic" of 25% and the stock went up 50%. Not anymore. Investors are not easily convinced anymore.

Monday, January 31, 2005

Saturday, January 29, 2005

01/28/2005 - More of the same - partie deux

Well, the market ended down. Surprised? I'm not. What happened in the news? Not enough.

- the Q4 employment cost index, which rose a smaller 0.7% (consensus +0.8%), the weakest overall rise since Q2 1999...

- Commerce Dept. showed 3.1% annual growth in advance Q4 GDP, less than the expected 3.5% growth rate, the data still suggest overall GDP growth in 2004 was the most robust since 1999 and still slightly above the 10-year trend...

- The GDP deflator (inflation) rose at a modest 2.0% annual rate, basically in line with economist's forecast of 2.1%...

You know, I have adjusted my game plan. It took me a few losses to get it through my thick skull that most equities are lethal right now. I moved some money into a fixed income mutual fund called EVERGREEN INCOME ADV (AMEX:EAD). Evergreen Income Advantage Fund will invest at least 80% of its assets in below investment-grade (high yield) debt securities, loans and preferred stocks, under normal market conditions. These securities are rated Ba or lower by Moody's Investors Service, Inc. or BB or lower by Standard & Poor's Ratings Group, or are unrated securities of comparable quality as determined by the fund's investment advisor.

The yield on the fund is 11%. I bought at $15.20. Here again, like the Nuveen Senior Income Fund, I don't expect too much capital appreciation or depreciation. My take is that it is not safe to be trafficking in equities now. It is important to keep a close eye on your capital...

- the Q4 employment cost index, which rose a smaller 0.7% (consensus +0.8%), the weakest overall rise since Q2 1999...

- Commerce Dept. showed 3.1% annual growth in advance Q4 GDP, less than the expected 3.5% growth rate, the data still suggest overall GDP growth in 2004 was the most robust since 1999 and still slightly above the 10-year trend...

- The GDP deflator (inflation) rose at a modest 2.0% annual rate, basically in line with economist's forecast of 2.1%...

You know, I have adjusted my game plan. It took me a few losses to get it through my thick skull that most equities are lethal right now. I moved some money into a fixed income mutual fund called EVERGREEN INCOME ADV (AMEX:EAD). Evergreen Income Advantage Fund will invest at least 80% of its assets in below investment-grade (high yield) debt securities, loans and preferred stocks, under normal market conditions. These securities are rated Ba or lower by Moody's Investors Service, Inc. or BB or lower by Standard & Poor's Ratings Group, or are unrated securities of comparable quality as determined by the fund's investment advisor.

The yield on the fund is 11%. I bought at $15.20. Here again, like the Nuveen Senior Income Fund, I don't expect too much capital appreciation or depreciation. My take is that it is not safe to be trafficking in equities now. It is important to keep a close eye on your capital...

Thursday, January 27, 2005

01/27/2005 - Today's Muse

A whole lot of nothing going on... I know, I have been kind of chasing ideas to invest in. It's not working. My last idea was Boeing, although it is a good company I shouldn't have touched it. I just don't see anything out there. I know, I know, invest in something with energy in it. At this point I feel that I am chasing energy. I put money in Foundation Coal (FCL) and Enterprise Products a while back. Those stocks are doing well. Still waiting for FCL to pick up some speed. I just don't have much conviction. We are back in the "old new economy," which equals the "old economy." Guard your money or go broke. The playground is just about empty. Time to go back to class and learn.

- An early surge in oil prices closer to $50/bbl, amid concerns of violence ahead of Sunday's Iraqi elections and uncertainty regarding OPEC's upcoming output decision

- December durable goods rose 0.6%, close to forecasts of +0.7%, November's figure was upwardly revised from 1.4% to 1.8% and orders, excluding transportation, were up 2.1%, indicating continued strength in underlying business investment... Weekly jobless claims coming in a bit lower than expected at 325K, marking the second consecutive week below 330K, has essentially erased concerns caused by the seasonally-influenced surge in initial benefits over the holidays and further reflected a respectable employment situation...

- An early surge in oil prices closer to $50/bbl, amid concerns of violence ahead of Sunday's Iraqi elections and uncertainty regarding OPEC's upcoming output decision

- December durable goods rose 0.6%, close to forecasts of +0.7%, November's figure was upwardly revised from 1.4% to 1.8% and orders, excluding transportation, were up 2.1%, indicating continued strength in underlying business investment... Weekly jobless claims coming in a bit lower than expected at 325K, marking the second consecutive week below 330K, has essentially erased concerns caused by the seasonally-influenced surge in initial benefits over the holidays and further reflected a respectable employment situation...

Wednesday, January 26, 2005

01/26/2005 - Moneyball

I just finished Moneyball last night. I enjoyed the book but I also like the way Michael Lewis writes too. I don't think I would have enjoyed the book as much as I did if Michael Lewis had not written the book. The book shows how to look at baseball through a spreadsheet. A game that was based on personalities, homeruns, and strikeouts is now sliced and diced down to a plethora of different metrics. What is the price of a "homerun hitter?" What would you pay for a "base stealer?" Billy Beane and the Oakland A's know. Now the Red Sox and the Blue Jays are learning. Interesting book. Fast read.

Nothing of GREAT importance has come out today on the news front. I am guessing that retailers will have a weak first qtr because of the bad weather in the Northeast. The bad weather will be what they blame it on, anyway.

OK, I know the market is up today. It was up yesterday too. I just don't feel it. I don't have much confidence in the market right now. Something is not right. I am standing still.

Nothing of GREAT importance has come out today on the news front. I am guessing that retailers will have a weak first qtr because of the bad weather in the Northeast. The bad weather will be what they blame it on, anyway.

OK, I know the market is up today. It was up yesterday too. I just don't feel it. I don't have much confidence in the market right now. Something is not right. I am standing still.

Tuesday, January 25, 2005

1/25/2005 - Notes

- an unexpected rise in January consumer confidence to 103.4 (consensus 101.3) did little to move stocks notably

- Existing home sales for December checked in at a 6.69 mln annual rate, slightly worse than the 6.80 mln

- Existing home sales for December checked in at a 6.69 mln annual rate, slightly worse than the 6.80 mln

Monday, January 24, 2005

01/24/2005 - Diggin' Out

Boy, what a snow storm we had this weekend! I was diggin' out all morning. And the Patriiots won again this weekend! A great game! Next stop - Jacksonville!

"While lackluster action on the part of buyers so far in 2005 is rather typical during the early part of earnings season, as the market usually rallies only after worries over individual stocks producing negative surprises subside, investors appear to be seeking bargains in a market that has so far overstated worries about decelerating earnings growth... " briefing.com

Still, looking at charts and sitting still.

"While lackluster action on the part of buyers so far in 2005 is rather typical during the early part of earnings season, as the market usually rallies only after worries over individual stocks producing negative surprises subside, investors appear to be seeking bargains in a market that has so far overstated worries about decelerating earnings growth... " briefing.com

Still, looking at charts and sitting still.

Saturday, January 22, 2005

01/21/2005 - Today's Notes

The market continues to digest all the news that is coming out. I am basically staying on the sidelines now. BA will be jettisoned soon as a way to raise cash if need be. Many of the stocks in the Dow are in a downtrend sans AIG, DIS, MO, PG, XOM.

- The University of Michigan has released a preliminary read on January consumer sentiment of 95.8, slightly less than expectations of 97.5

PM Notes

Another down day. I am wondering what it will take to move the market higher? Earnings have been coming in OK. Nothing great. Nothing bad. Could we be at the end of a bull market? Is the market figuring that Q2 is going to disappoint? Looking at the Dow stocks, they are going down. It is a little strange that even the big pharmaceuticals are going down. I thought these stocks were safe havens in times of trouble.

Energy has done well. Maybe energy stocks are the new pharmaceuticals? People have figured out that there is only so much oil in the ground. There is a new country emerging, called China that I guess wants some of this energy too. The perception of energy has change and investors want it. Do people still need their heart medication? What about Viagra? My guess is that the generic drug manufactures have changed the playing field a bit. There are now companies that can produce a cheaper drug... but there are no companies that can produce cheaper oil/gas/diesel. I guess that is the difference.

Enough of my soap box drivel. I sold BA. Time to raise cash. Time to sit still.

Have a great weekend!

- The University of Michigan has released a preliminary read on January consumer sentiment of 95.8, slightly less than expectations of 97.5

PM Notes

Another down day. I am wondering what it will take to move the market higher? Earnings have been coming in OK. Nothing great. Nothing bad. Could we be at the end of a bull market? Is the market figuring that Q2 is going to disappoint? Looking at the Dow stocks, they are going down. It is a little strange that even the big pharmaceuticals are going down. I thought these stocks were safe havens in times of trouble.

Energy has done well. Maybe energy stocks are the new pharmaceuticals? People have figured out that there is only so much oil in the ground. There is a new country emerging, called China that I guess wants some of this energy too. The perception of energy has change and investors want it. Do people still need their heart medication? What about Viagra? My guess is that the generic drug manufactures have changed the playing field a bit. There are now companies that can produce a cheaper drug... but there are no companies that can produce cheaper oil/gas/diesel. I guess that is the difference.

Enough of my soap box drivel. I sold BA. Time to raise cash. Time to sit still.

Have a great weekend!

Thursday, January 20, 2005

01/20/2005 - ho hum...

The market is just churning like cud in a cow's mouth. Earnings are just "ho hum." Trader Mike had the right idea by waiting until earnings season is over before he did anything. I myself am thinking that I have to re-frame my trading approach. The market has changed and my trading approach is not efficient anymore. This is a great example why you should not buy a "trading system." You have to be able to change when the market changes.

Yes, I am long BA but I will sell at $51.88 or $50.60.

PM Notes

Yup - another dull day on the street. Now is the time to really pay attention. When, things get "dull," keep looking. So what happened today?

- Dec leading indicators, which matched forecasts of 0.2%

- Jan Philadelphia Fed index, which came in at 13.2 (consensus 25.0), showing a slower pace of manufacturing expansion than in 2004 but still exhibiting respectable growth...

Nuveen Senior Income Fund (NSL) - which I bought a couple months back has moved up a little. This fund offers a nice div yield and the capital appreciation has been a bonus. NSL was purchased at $9.22 and trades at $9.63 today. I will continue holding it until I need to raise cash.

Yes, I am long BA but I will sell at $51.88 or $50.60.

PM Notes

Yup - another dull day on the street. Now is the time to really pay attention. When, things get "dull," keep looking. So what happened today?

- Dec leading indicators, which matched forecasts of 0.2%

- Jan Philadelphia Fed index, which came in at 13.2 (consensus 25.0), showing a slower pace of manufacturing expansion than in 2004 but still exhibiting respectable growth...

Nuveen Senior Income Fund (NSL) - which I bought a couple months back has moved up a little. This fund offers a nice div yield and the capital appreciation has been a bonus. NSL was purchased at $9.22 and trades at $9.63 today. I will continue holding it until I need to raise cash.

Wednesday, January 19, 2005

01/19/2005 - Today's Notes

The market seems to be digesting the batch of earnings reports OK. Today we have some key numbers coming out, which appear somewhat benign.

- Dec CPI just checked in at -0.1% (consensus 0.0%) (due in large part to a 1.8% decline in energy prices)

- Core CPI came in at +0.2% (consensus +0.2%)

- Weekly jobless claims fell 48K to 319K (consensus 345K)

BA is down a bit today. I am still long. Stop at $49.94.

PM Notes

More of the same. The market really does not know what it wants to do. I thought BA was going to close higher today given its end of the day strength. Seems once the Beige Book was released, stocks headed south again. It is somewhat disheartening to be in markets like this. The key is survival. You don't want to swing for the fences. Be patient and wait for the pitch to come to you. I am long BA. Once we get past earnings season, the market should be less temperamental.

- Evidence that the overall trend in housing remains flat, another bullish signal erased by the bears, was witnessed when housing starts jumped 11% to 2.0 mln (consensus 1.91 mln) and building permits came in at 2.0 mln (consensus 1.99 mln)...

- Dec CPI just checked in at -0.1% (consensus 0.0%) (due in large part to a 1.8% decline in energy prices)

- Core CPI came in at +0.2% (consensus +0.2%)

- Weekly jobless claims fell 48K to 319K (consensus 345K)

BA is down a bit today. I am still long. Stop at $49.94.

PM Notes

More of the same. The market really does not know what it wants to do. I thought BA was going to close higher today given its end of the day strength. Seems once the Beige Book was released, stocks headed south again. It is somewhat disheartening to be in markets like this. The key is survival. You don't want to swing for the fences. Be patient and wait for the pitch to come to you. I am long BA. Once we get past earnings season, the market should be less temperamental.

- Evidence that the overall trend in housing remains flat, another bullish signal erased by the bears, was witnessed when housing starts jumped 11% to 2.0 mln (consensus 1.91 mln) and building permits came in at 2.0 mln (consensus 1.99 mln)...

Tuesday, January 18, 2005

01/18/2005 - WOW! It is cold here!

1/18/2005

Good morning to all! I hope you all had a nice long weekend. I know some of you worked too. It is quite cold here in Boston and the Northeast. This bodes well for energy.

- the January NY Empire State index, which fell to 20.08 from a revised 27.07 read in December... While this month's figure was weaker than economists' forecasts of 25.0, the data are still suggestive of an expanding manufacturing sector as any reading over zero reflects growth...

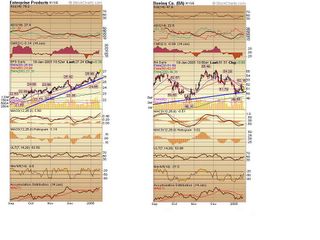

BA, EPD and FCL are all up this AM. I am watching BA closely. In hindsite, I think I should have waited for BA to trend rather than range. Take a look at the BA chart Vs. the EPD chart. Look at the difference! I want EPD stocks. Who wouldn't? Although, I am sure BA won't be going out of business soon, it takes more energy and concentration to make money in a BA situation than an EPD. I know, I know - easier said than done...

PM Notes

The market had a nice day. BA was up $0.97 today.

- Positive remarks from Lehman Brothers regarding increased deliveries of commercial aircraft have helped Boeing.

I continue being long BA.

"The most dangerous moment comes with victory." Napoleon Bonaparte (1769 - 1821)

Sunday, January 16, 2005

Friday, January 14, 2005

01/14/2005 - I continue to be cautious...

The market opened higher today - BA is down. You probably read the news on BA.

- announcing plans to recognize Q4 (Dec) pre-tax charges totaling about $615 mln

I am still long BA. I must say I am surprised by BA's action.

I was thumbing through the January issue of Stocks & Commodities and read an interesting interview with Don Miller. He said something we all know but sometimes forget.

"People need to understand that the market is imperfect: You have all these trading segments trading all different strategies and different time frames, so every single pattern is going to look different. And you won't always be on your game.... You've got to understand that."

What are we looking at today?

- Dec PPI checked in at -0.7% (consensus -0.2%) while core PPI rose +0.1 (consensus +0.2%)

With the December core rate coming in a bit better than anticipated, however, it appears inflation so far remains contained

- November Business Inventories came in at 1.0% (consensus +0.6%)

- Capacity Utilization checked in at 79.2% (consensus 78.9%), not yet suggestive of inflation concerns but beginning to grab attention, as 80% remains the hypothetical mark where inflation picks up...

I continue to be cautious...

Market Closed...

We go into the long- weekend on an "up note."

"With inflation in check and good underlying growth indicated by stronger than expected economic data, concerns of an oversold market were removed as broad-based buying interest pushed virtually every sector into positive territory..." - Briefing.com

It was nice to see the market come back from this morning's lows. It was also nice to see BA pick its head up a little. I particularly liked that the Bulls were able to bring the stock up from its daily lows and close +$0.28 for the day. I am long BA with a stop at $49.94.

I am happy with energy too. EPD and FCL continue to move up. FCL has not been as easy to watch but I do think coal will be strong now that oil seems to be off its lows.

I hope all have a nice weekend...

- announcing plans to recognize Q4 (Dec) pre-tax charges totaling about $615 mln

I am still long BA. I must say I am surprised by BA's action.

I was thumbing through the January issue of Stocks & Commodities and read an interesting interview with Don Miller. He said something we all know but sometimes forget.

"People need to understand that the market is imperfect: You have all these trading segments trading all different strategies and different time frames, so every single pattern is going to look different. And you won't always be on your game.... You've got to understand that."

What are we looking at today?

- Dec PPI checked in at -0.7% (consensus -0.2%) while core PPI rose +0.1 (consensus +0.2%)

With the December core rate coming in a bit better than anticipated, however, it appears inflation so far remains contained

- November Business Inventories came in at 1.0% (consensus +0.6%)

- Capacity Utilization checked in at 79.2% (consensus 78.9%), not yet suggestive of inflation concerns but beginning to grab attention, as 80% remains the hypothetical mark where inflation picks up...

I continue to be cautious...

Market Closed...

We go into the long- weekend on an "up note."

"With inflation in check and good underlying growth indicated by stronger than expected economic data, concerns of an oversold market were removed as broad-based buying interest pushed virtually every sector into positive territory..." - Briefing.com

It was nice to see the market come back from this morning's lows. It was also nice to see BA pick its head up a little. I particularly liked that the Bulls were able to bring the stock up from its daily lows and close +$0.28 for the day. I am long BA with a stop at $49.94.

I am happy with energy too. EPD and FCL continue to move up. FCL has not been as easy to watch but I do think coal will be strong now that oil seems to be off its lows.

I hope all have a nice weekend...

Thursday, January 13, 2005

01/13/2005 - Boeing

Hello to all. The market has been pretty choppy. As I said earlier, I have taken a cautionary approach to the market for now. That being said, I did buy some Boeing (BA) this morning at a price of $51.65 per share. The chart on BA looks rather bullish. I know the stock hit a 52-week high not too long ago, but this stock looks like there is some good buying behind it. I have a stop at $49.94 in case of any downdraft. Otherwise, I am keeping a low profile in the market. That's all for now.

Early Afternoon Update

BA has experience some selling today. I am still long the stock. I feel that much of the selling is due to yesterday's gain. I am curious to see what happens in late day trading. If the stock continues to be weak in the late afternoon, I will assume that we are not working off yesterday's rally anymore. There could be something more serious at hand.

Markets Closed...

Ouch! BA did not show much strength today. I was pretty confident that BA had the strength to move up. I did not expect the stock to reach a new high but maybe up to $52.50 or so. I am still long on the stock.

The Market just seems to be reacting to bad news after bad news. Here are some examples of news items that came out today:

- a GM warning

- a Treasury Dept. ruling that companies won't be allowed to repurchase stock or pay dividends with repatriated foreign earnings

- a 3.5% surge in crude oil ($48.04/bbl +$1.67)

- Verizon Communications (VZ 37.00 -1.23), which was downgraded by both CSFB and Robert W. Baird

- An FDA warning about Pfizer's (PFE 25.37 -0.66) controversial painkiller ads

I am not much of a forecaster. Maybe I got caught in a death trap today? You know, the market shows strenth but it is really bleeding like hell. You buy on strength only to get whipsawed. Today, BA showed huge selling in the late stage on the market. Not good...

John Murphy's Market Message Jan 13, 2005 had some interesting things to say too.

"It looks to me like the downside correction is oil is over and that it's headed higher again. Energy stocks, which are today's strongest group again, are leading the commodity higher."

"Oil service stocks remain the strongest part of the energy patch."

The NYSE Tick was +77. That is pretty much a nonevent. Can't say that I am too excited about the market right now. I await tomorrow's news and will make and needed adjustments.

bonne nuit

Early Afternoon Update

BA has experience some selling today. I am still long the stock. I feel that much of the selling is due to yesterday's gain. I am curious to see what happens in late day trading. If the stock continues to be weak in the late afternoon, I will assume that we are not working off yesterday's rally anymore. There could be something more serious at hand.

Markets Closed...

Ouch! BA did not show much strength today. I was pretty confident that BA had the strength to move up. I did not expect the stock to reach a new high but maybe up to $52.50 or so. I am still long on the stock.

The Market just seems to be reacting to bad news after bad news. Here are some examples of news items that came out today:

- a GM warning

- a Treasury Dept. ruling that companies won't be allowed to repurchase stock or pay dividends with repatriated foreign earnings

- a 3.5% surge in crude oil ($48.04/bbl +$1.67)

- Verizon Communications (VZ 37.00 -1.23), which was downgraded by both CSFB and Robert W. Baird

- An FDA warning about Pfizer's (PFE 25.37 -0.66) controversial painkiller ads

I am not much of a forecaster. Maybe I got caught in a death trap today? You know, the market shows strenth but it is really bleeding like hell. You buy on strength only to get whipsawed. Today, BA showed huge selling in the late stage on the market. Not good...

John Murphy's Market Message Jan 13, 2005 had some interesting things to say too.

"It looks to me like the downside correction is oil is over and that it's headed higher again. Energy stocks, which are today's strongest group again, are leading the commodity higher."

"Oil service stocks remain the strongest part of the energy patch."

The NYSE Tick was +77. That is pretty much a nonevent. Can't say that I am too excited about the market right now. I await tomorrow's news and will make and needed adjustments.

bonne nuit

Tuesday, January 11, 2005

01/11/2005 - December Wrap Up

December was an anemic month for my portfolio. I was up about 0.43%, which is pretty poor actually. At least I know who to blame for the pisspoor performance, me. The S&P Spiders (SPY) were up about 2.29% (does not include dividends reinvested, that would really skew the returns. I don't have the dividends coming in like the S&P 500. I feel this is a closer measure of performance.).

I lost some money on the OSIP trade. I still laugh at that one. Otherwise, I have been just plugging along.

Since I began "keeping score" back in July, I am up 7.03% between the 7/31 - 12/31/2004 time period. The SPY was up 9.56% for the same time period. If I did not enjoy the stock market so much I would probably put my account into an idex fund or something of that ilk. I do believe I will catch returns. You can't give up.

I lost some money on the OSIP trade. I still laugh at that one. Otherwise, I have been just plugging along.

Since I began "keeping score" back in July, I am up 7.03% between the 7/31 - 12/31/2004 time period. The SPY was up 9.56% for the same time period. If I did not enjoy the stock market so much I would probably put my account into an idex fund or something of that ilk. I do believe I will catch returns. You can't give up.

Monday, January 10, 2005

01/10/2005 - AM Notes -first SEC "crackdown"

Good Morning Vietnam! I did a little reading this weekend but not as much as I had hoped. I did look at Barron's. I am amazed by the mentioning of the blogs in Barron's over the past weeks. The community of investing blogs is rather small but I have a feeling that this number will increase exponentially. I also look forward to the first SEC "crackdown" because some nincompoop who works for a major investment house decided to share ideas about his trading account. I can see the headline now: "SEC Probes Investing Blogs."

I have pulled in my horns a bit over the last week. I am waiting and posturing for my next move. I don't plan on putting my money in an Index fund. I remember reading a passage in Running Money By Andy Kessler.

"Those 'families with substantial assets' had wealth, but it wasn't static. Every generation it shrank unless they chased returns. No rest for the weary. But they don't like risk. Well, too bad. I think what I learned is that wealth comes not just from taking risk but from constantly taking risks."

I will continued to "chase returns!" I just hope that I catch them. ;)

Cheers,

Jeff

I have pulled in my horns a bit over the last week. I am waiting and posturing for my next move. I don't plan on putting my money in an Index fund. I remember reading a passage in Running Money By Andy Kessler.

"Those 'families with substantial assets' had wealth, but it wasn't static. Every generation it shrank unless they chased returns. No rest for the weary. But they don't like risk. Well, too bad. I think what I learned is that wealth comes not just from taking risk but from constantly taking risks."

I will continued to "chase returns!" I just hope that I catch them. ;)

Cheers,

Jeff

Friday, January 07, 2005

01/07/2005 - P.M. Notes

Good evening to all. I was just looking at some charts that make up the DJIA and I am concerned. Just about every chart I looked at shows weakness. The Bears have arrived. I am staying on the sidelines until I see a little energy come back into the Market. Two stocks that stick out are the "Win-Tel" brothers. Microsoft and Intel charts look downright anemic! Have these two growth companies of the 1980's and 1990's become stalwarts? Can we expect 3% dividend yields from these guys in the not too distance future?

To me it looks like every stock in the DJIA is rolling over. I am not savvy enough to make money in a bad market. You saw what I did with J.Jill. My best move right now is to go back to my den and wait this one out.

Cheers,

Jeff

To me it looks like every stock in the DJIA is rolling over. I am not savvy enough to make money in a bad market. You saw what I did with J.Jill. My best move right now is to go back to my den and wait this one out.

Cheers,

Jeff

01/07/2005 - A.M. Notes

OK, J.Jill did not work out. I did sell the stock this AM. I am feeling a bit discouraged but I must remember that this is not the end by any means. I am alive and well to fight another day. It is time for me to pull back and regroup. I think I got a little sloppy on J.Jill. They say that the major difference between a professional and amateur trader is how they handle their losses. The pros take very small losses. You can't escape losses but you keep them small.

I am sitting tight for now.

GRACE W R CO. is a no go for today.

I am sitting tight for now.

GRACE W R CO. is a no go for today.

Thursday, January 06, 2005

01/06/2005 - P.M. Notes

The bears won with J.Jill today. I did not sell even though my stop was at $14.76. I watched the stock pretty closely and actually thought it may close unchanged today. Tomorrow, I am not going to give this stock anymore room. I am just curious (curiosity killed the cat) to see if there is any strength on the stock tomorrow. It took a good drubbing today.

I am looking at stock for tmrw, GRACE W R CO NEW (NYSE:GRA). Stock has no upcoming events trades at $13.00. Lets see what happens in tmrws open.

I am looking at stock for tmrw, GRACE W R CO NEW (NYSE:GRA). Stock has no upcoming events trades at $13.00. Lets see what happens in tmrws open.

01/06/2005 J.Jill Chart

We are in the midst of a Bull vs. Bear fight concerning J.Jill. News came out early this AM that JILL had some trouble in their last quarter. The stock was down to about $13.82 in pre-market trading. Right now it is down about 18 cents from yesterday's close.

The indicators that I am looking at look OK, except one, which I point out above.

My feeling is that by the end of trading today, we will know the short-term fate of JILL.

Stay tuned...

Wednesday, January 05, 2005

Fed Minutes Suggest It Won't Pause (WSJ)

In case you did not notice, the title of my headline was plagiarized from the Wall Street Journal. Why did I do this? Two reasons:

1) I wanted to remind myself not to simply parrot what other news sources are saying. A blog is suppose to be original. It is suppose to add value by sharing personal experiences. If you find that you are simply reading news that is being passed on through this blog, write me a nasty email and let me know.

2) The second reason has to do with perception. The Market moves on perception. Once something is in writing, it is old news. When we trade, we are trading perceptions. We are trading people, as stated in the book, Tools and Tactics for the Master DayTrader: Battle-Tested Techniques for Day, Swing, and Position Traders by Oliver Velez, Greg Capra. Traders and investors are perceiving what may happen by headlines. It seems scary. Putting your money into a perception. Capitalism at its best!

How is J.Jill doing? It is at about $15.06. I still have my stop at $14.76. Retailers are a funny group. Basically what's in fashion goes up and the opposite is true too. It's that simple. I don't trust J.Jill. I am ready to sell anytime.

1) I wanted to remind myself not to simply parrot what other news sources are saying. A blog is suppose to be original. It is suppose to add value by sharing personal experiences. If you find that you are simply reading news that is being passed on through this blog, write me a nasty email and let me know.

2) The second reason has to do with perception. The Market moves on perception. Once something is in writing, it is old news. When we trade, we are trading perceptions. We are trading people, as stated in the book, Tools and Tactics for the Master DayTrader: Battle-Tested Techniques for Day, Swing, and Position Traders by Oliver Velez, Greg Capra. Traders and investors are perceiving what may happen by headlines. It seems scary. Putting your money into a perception. Capitalism at its best!

How is J.Jill doing? It is at about $15.06. I still have my stop at $14.76. Retailers are a funny group. Basically what's in fashion goes up and the opposite is true too. It's that simple. I don't trust J.Jill. I am ready to sell anytime.

Tuesday, January 04, 2005

01/04/2005 - Just a small downdraft...

What a day on the Street! Many portfolios got trimmed today. J.Jill, the stock I bought today was down to $15.05 the last time I checked. Energy was down too! All US Industry Indices were down. It is true that the Bull Market is getting "long in the tooth." (side note: When horses were sold, the teeth were checked to tell how old they were. As they aged, their gums receded and the teeth appeared to be longer.) As you know I don't forecast. I listen. Right now I am listening to stocks moving south. I won't hesitate to sell some holdings if the Market continues to breakdown. Lets hope the bloodletting stops tomorrow.

On a side note, I would like to mention that any "trader" is doing themselves a disservice if they are judging each trade as if it is their last. Back to my football analogies. The game is not decided by one play. The game is made of many plays by each team. Just because one team throws and interception does not mean the game is over.

So, be sure to base your trading performance on intervals of ten trades. Only then can you see if there is a true flaw in your system. Only then can you see a big picture.

On a side note, I would like to mention that any "trader" is doing themselves a disservice if they are judging each trade as if it is their last. Back to my football analogies. The game is not decided by one play. The game is made of many plays by each team. Just because one team throws and interception does not mean the game is over.

So, be sure to base your trading performance on intervals of ten trades. Only then can you see if there is a true flaw in your system. Only then can you see a big picture.

01/04/2005 - J.Jill looks good...

Hello to all. I hope you had a nice New Years Eve! I have been looking at a couple ideas and have come across one, which I am taking some action. J.Jill, the stock has been over-sold and looks like a nice swing trade. I am in at $15.30. I am taking this pitch. I know retailers are of an insidious ilk but I like the odds on this one. I have a stop at $14.76.

Subscribe to:

Posts (Atom)