I am looking forward to a challenging and exciting investing experience this 2006! My New Years Resolution to you is to make sure that I stay on top of my game and give you some good investing ideas for 2006. Remember, I am starting out with $50K. I already made one losing decision by buying CAG and selling at a small loss. I am out of that and have no holdings now. We are going to have other losers in 2006 I am sure! The important concept is to make sure that our losers are small and our winners our huge!

So, to you and yours - Happy New Year! Lets make some $$$$$$$ !!!!!!

Jeff

Saturday, December 31, 2005

Friday, December 30, 2005

Last Day of Trading for 2005!

DOW 30

So today was the last trading day of 2005! I was pretty much removed from the market today. I was over at Wal Mart buy some tee shirts for 2006! I noticed a few things today.

AIG - hit resistance at $69

CAT - hit resistance at $60

GM - Bouncing off support at $18. I would not feel comfortable owning thing one. I know there are too many problems. Will be very erratic!

JNJ - hit support at $60.

KO - I actually sold this a couple weeks back. I had a few shares from a gift a long time ago (like 13 years). Anyway, the 1980's and 1990's. KO is facing great competition and their management is weak. Lets move the money into something with better chances.

BANKS - JPM and C - hit resistance too.

Misc.

RTN - Hitting new area highs. Keep an eye on this one. Lets look for any signals of a short play.

So today was the last trading day of 2005! I was pretty much removed from the market today. I was over at Wal Mart buy some tee shirts for 2006! I noticed a few things today.

AIG - hit resistance at $69

CAT - hit resistance at $60

GM - Bouncing off support at $18. I would not feel comfortable owning thing one. I know there are too many problems. Will be very erratic!

JNJ - hit support at $60.

KO - I actually sold this a couple weeks back. I had a few shares from a gift a long time ago (like 13 years). Anyway, the 1980's and 1990's. KO is facing great competition and their management is weak. Lets move the money into something with better chances.

BANKS - JPM and C - hit resistance too.

Misc.

RTN - Hitting new area highs. Keep an eye on this one. Lets look for any signals of a short play.

Thursday, December 29, 2005

My Xmas Present - Siri

I received Sirius Radio for Xmas! It is a gift that I would have not bought myself but I really am enjoying it! Great selection of music and no annoying ads! It makes listening to the "radio" enjoyable.

I like it so much that I was tempted to buy the stock. Remember one of those axioms, " it may be a good company but not a good stock." Something like that. Looking at the chart I see that $8 mark is pretty meaningful. If the stock moves above that mark with some power, it may be worth buying into. Otherwise, it could flounder a bit.

I like it so much that I was tempted to buy the stock. Remember one of those axioms, " it may be a good company but not a good stock." Something like that. Looking at the chart I see that $8 mark is pretty meaningful. If the stock moves above that mark with some power, it may be worth buying into. Otherwise, it could flounder a bit.

Wednesday, December 28, 2005

Slow Days

So, I did sell CAG yesterday. I really did not have a choice. The market is waiting for more info about how CAG is going to turn things around. I had no choice.

I am keeping my eye on a few stocks though - HNZ, CMCSA, RSH. These stocks look interesting in that something could change and a true could start.

I am keeping my eye on a few stocks though - HNZ, CMCSA, RSH. These stocks look interesting in that something could change and a true could start.

Tuesday, December 27, 2005

CAG

AM

Okay, I am getting concerned with CAG. If there is more weakness in the stock today I will have to sell. The idea is to protect your capital and let profits ride. My feeling is that there may be too much uncertainty in the stock now. The market was hoping for more from the CEO last week and they did not get what they wanted. March is when more detailed info will come out. This could be a problem!

UPDATE

CAG was sold today at $20.26. I would rather step aside and wait for the CEO to get a plan together and join in when the others do. The market was expecting more than they got from the new vision.

Note: Bought at $20.89.

Okay, I am getting concerned with CAG. If there is more weakness in the stock today I will have to sell. The idea is to protect your capital and let profits ride. My feeling is that there may be too much uncertainty in the stock now. The market was hoping for more from the CEO last week and they did not get what they wanted. March is when more detailed info will come out. This could be a problem!

UPDATE

CAG was sold today at $20.26. I would rather step aside and wait for the CEO to get a plan together and join in when the others do. The market was expecting more than they got from the new vision.

Note: Bought at $20.89.

Friday, December 23, 2005

Slow day CAG is held

A slow day, I am sure most of the heavy hitters packed it up and went home until 2006. I am still holding CAG even though it dropped below my stop target. First, with such light trading I did not think this was a great day to sell. Also, this stock had major support at the $20.30 mark.

As time moves ahead and this stock is still sluggish, I won't waste any time selling it. I must say that I was expecting a pop in the stock that has not occurred.

As time moves ahead and this stock is still sluggish, I won't waste any time selling it. I must say that I was expecting a pop in the stock that has not occurred.

Thursday, December 22, 2005

Hard Day for CAG

CAG had its analysts quarterly earnings report today. There was a sell off but the stock is still being held. If the stock goes below $20.47, then I will sell.

Wednesday, December 21, 2005

WFR - oh that hurts - like CAG

Did you see MEMC today, up $1 on the open! Yesterday I sold the sucker. You really have respect the markets. It can drive you crazy if you let it. Remember, this is a huge learning process and admission is expensive!

I bought CAG today at $20.89. Please see my trade portfolio for all my action. I am starting my 2006 concept before the New Year! Money never sleeps.

I bought CAG today at $20.89. Please see my trade portfolio for all my action. I am starting my 2006 concept before the New Year! Money never sleeps.

Tuesday, December 20, 2005

Oops on WFR

I sold WFR this AM. You know, that really irked me. I went into MCD and made a pretty good trade. I knew what I was doing and liked the set up on MCD. Made some money and then went into WFR. I did think the stock could shoot up but I think was really rolling the dice. I sold at a loss and I feel stupid that I rolled the dice like a fool. No excuses...

Friday, December 16, 2005

I keep forgetting

Who said investing was easy. Right when you think you are learning, you start forgetting. In search of the Holy Grail, as some would call it, you forget what "works." Now, what "works" for me is different than what "works" for you.

Remember -

1) Be Patient

2) Don't Get Fancy

3) There is no such thing as a perfect trade or investment (you make money or lose money)

4) Keep an open mind

Right now, I do not have any trade ideas. I have my eyes open.

UTX IS STALLING

Looking at todays close of UTX does not make me bullish. Is it time for UTX to rest after its huge run up? The odds say YES!

Remember -

1) Be Patient

2) Don't Get Fancy

3) There is no such thing as a perfect trade or investment (you make money or lose money)

4) Keep an open mind

Right now, I do not have any trade ideas. I have my eyes open.

UTX IS STALLING

Looking at todays close of UTX does not make me bullish. Is it time for UTX to rest after its huge run up? The odds say YES!

Tuesday, December 13, 2005

I thought so - DPZ has a large stone tied to it.

Just for S and Gs I went to an Insider Trading website to see if Dominos was was being dumped by the VCs. Take a look for yourself. I would wait until you see DPZ trade over $25 for a few days before buying. There is a lot of overhead supply and I am not privy to Bain's trading book so I don't know what their plans are. You may want to stay the hell away for a while.

Monday, December 12, 2005

Flat for the day

I guess many are waiting for the Fed to meet and do what they are expected to do. MEMC moved up a bit today. I am still long that one.

In other ratings moves, Morgan Stanley upgraded United Technologies (UTX) to overweight from equal-weight, as the broker believes the company isn't getting enough attention for its aerospace upcycle. United Technologies was higher by 13 cents, or 0.2%, to close at $55.55. OK, I don't understand this comment - I mean take a look at the chart of UTX. The stock has moved from about $50 to $56. The stock seemed to getting attention to me. The stock did move through major resistance and continues to move up.

In other ratings moves, Morgan Stanley upgraded United Technologies (UTX) to overweight from equal-weight, as the broker believes the company isn't getting enough attention for its aerospace upcycle. United Technologies was higher by 13 cents, or 0.2%, to close at $55.55. OK, I don't understand this comment - I mean take a look at the chart of UTX. The stock has moved from about $50 to $56. The stock seemed to getting attention to me. The stock did move through major resistance and continues to move up.

Saturday, December 10, 2005

A Tough Week!

"We're going nowhere fast because we don't have a lot of meaningful news," said Paul Nolte, director of investments with Hinsdale Associates. "We've been left to trade on interest rates and crude oil, both of which have been very volatile."

Traders are now looking ahead to Tuesday, when the Federal Reserve is expected to bump up fed funds by another quarter-point to 4.25%.

My Thoughts

I have to agree. I bought some MEMC (WFR) at $24.15 and saw the stock head south pretty fast after that! I still own it though. The word is that demand for the chips is here. However, there is a silicon shortage, which MEMC can produce. So the stock should go up. See chart here. I feel the buyers are still around for this stock. This past week was pretty volitile but I feel that was due to Intel coming out with news and the market unsure of what to expect. If there is weakness in the coming week, MEMC could be done for a while. Time will tell.

I bought some MCD last week at $34.14 and sold at $34.99. MCD is have a hard time getting past the $35 mark. I like their Chipolte IPO but I don't want to hang around just for that. I am waiting to see if this stock can trade over the $35 area on good volume.

Traders are now looking ahead to Tuesday, when the Federal Reserve is expected to bump up fed funds by another quarter-point to 4.25%.

My Thoughts

I have to agree. I bought some MEMC (WFR) at $24.15 and saw the stock head south pretty fast after that! I still own it though. The word is that demand for the chips is here. However, there is a silicon shortage, which MEMC can produce. So the stock should go up. See chart here. I feel the buyers are still around for this stock. This past week was pretty volitile but I feel that was due to Intel coming out with news and the market unsure of what to expect. If there is weakness in the coming week, MEMC could be done for a while. Time will tell.

I bought some MCD last week at $34.14 and sold at $34.99. MCD is have a hard time getting past the $35 mark. I like their Chipolte IPO but I don't want to hang around just for that. I am waiting to see if this stock can trade over the $35 area on good volume.

The New Format Is Here In 2006

For those of you who read my blog, I thank you and hope I might have a couple interesting things for you to read. Also, for the year of 2006, I am going to keep track of a portfolio that starts with $50K. I am not saying whether the money is real or fake, I will let you decide. I will also disclose all my "moves" and let you see my performance and diary notes on a timely basis. I can't wait to begin!!!

Friday, December 09, 2005

Price Resistance -

Looking at a few charts and it is quick noticable how stocks will hit resistance at round numbers. For example:

Dominos = $25 - I think it is Bain Capital selling at that level.

AIG - $70

AXP - $53

BA - $70

CAT - $60

C - $50

GE - $37

HPQ - $30

IBM - $90

Anyway, I think you get the point. I never realized that these price points were so strong. Something to think about when you are about to buy or sell.

Dominos = $25 - I think it is Bain Capital selling at that level.

AIG - $70

AXP - $53

BA - $70

CAT - $60

C - $50

GE - $37

HPQ - $30

IBM - $90

Anyway, I think you get the point. I never realized that these price points were so strong. Something to think about when you are about to buy or sell.

Thursday, December 08, 2005

the Semiconductors

Much has been said about the semiconductor and the shortage in silicon for the wafers, I guess we are waiting for Intel to come out and give us some news today. I am waiting for the semiconductor stocks to take off and not look back. I remember when the cycle were so crisp and clean that you could just buy and hold until the cycle was over. Now, there are a lot of false starts it seems.

Remember: Bulls live above the 200-day moving average while bears live below it.

Remember: Bulls live above the 200-day moving average while bears live below it.

Tuesday, December 06, 2005

Cramer and the financials aka banks

Last night I started to watch Mad Money and Cramer started out with a lecture on buying the financials or buying one good one. I had to shut off the TV because I have been watching the financials (JPM and C) go up for the last couple weeks! Come on Cramer! We knew about this a month ago!

Anywho, Cramer has to do a TV show and talk about something.

Also, only 15-20% of stock actually will trend. Something to think about when you are holding onto that stock that you hope will go to the moon. Should you sell?

Anywho, Cramer has to do a TV show and talk about something.

Also, only 15-20% of stock actually will trend. Something to think about when you are holding onto that stock that you hope will go to the moon. Should you sell?

Friday, November 11, 2005

Flying at 30,000 feet

It is hard trying to figure out what is happening with a market or stock - I think. One thing that I find helpful is not getting to caught up in the moment. You really have to balance the big picture with the small picture. I think it is helpful to remind yourself to step back to a different focal point.

Thursday, November 10, 2005

Musings, ramblings and thoughts...

I was thinking yesterday about the effects of speculating on the human mind. Speculating can take an emotional toll on the human due to the fact that the human can go back at a point in time to see how they would have performed if they had only held on to their stock. They make a decision to never let that happen again. So, they hold on to too long and get killed the next time. The idea is simple. Take money out of the markets. Let your winners fly and kill your losers - fast. This is a messy business and if you are concerned that your accountant will wonder why all the trades then you are doing it for the wrong reasons.

Tuesday, November 08, 2005

BA

BA, I thought was a good short idea but as time moves forward, I am not too sure. In other words, I don't know. I think that is a good reason to step aside and wait until the picture is more clear.

BA continued down. Maybe the picture is more clear. INTC is moving up still, although just by a small amount.

BA continued down. Maybe the picture is more clear. INTC is moving up still, although just by a small amount.

Monday, November 07, 2005

MSFT

So MSFT may buy some of AOL. I can't say that I am surprised at the idea since the stock has been moving up a few weeks prior. I was actually thinking that there was something going on - I did not know what though.

INTC looks nice now too. Are they making a deal with AAPL? What is the chart saying?

INTC looks nice now too. Are they making a deal with AAPL? What is the chart saying?

Tuesday, October 25, 2005

shift?

Today was a hard day in the market. There are some trends that I was looking at that have "blipped." Specifically, I am talking about WMT and HPQ. Tomorrow will be an interesting day. I would expect the market to be up but if not, the market is very concerned with the consumer confidence index and the employment rate issues. I think much of HPQ's loss today was due to Lexmark's poor performance. My gut feel is that HPQ is taking business from Lexmark and HPQ will continue its turnaround. I will let the market decide that though.

Friday, October 21, 2005

Volume

You know, I was thinking how these books on trading tell you how to look for big volume as a signal to buy or sell. I agree with them but I do not think it is that easy. Look, these institutions are smart. They don't want to put up a big flag and say, "hey look, we are buying (or selling)." No, they want to be quiet. So, don't think that volume is a big telltale sign. You have to focus on price and the close on the day.

This is fun! New Title!

Speculate : to assume a business risk in hope of gain; especially : to buy or sell in expectation of profiting from market fluctuations.

You may have noticed that I changed the title name of my blog. I must admit that it took me many years to accept the word "speculate" into my realm of thinking. I was bought up to "invest!" It seems like people feel better if they lose money on an "investment" opposed to a "speculation." Investing means you put money into something and ride out the ups and downs. This includes riding something into the ground. Investing is associated with being "responsible" and "mature." I guess that is a better way to lose money.

After about sixteen years of watching the market and "investing," I am not comfortable making a decision and putting it on autopilot. No, I want to make money! I am not too proud to change my mind if the market changes its mind about a company. Do you think a little guy like me is going to argue with the institutions out there?! No way!

You may have noticed that I changed the title name of my blog. I must admit that it took me many years to accept the word "speculate" into my realm of thinking. I was bought up to "invest!" It seems like people feel better if they lose money on an "investment" opposed to a "speculation." Investing means you put money into something and ride out the ups and downs. This includes riding something into the ground. Investing is associated with being "responsible" and "mature." I guess that is a better way to lose money.

After about sixteen years of watching the market and "investing," I am not comfortable making a decision and putting it on autopilot. No, I want to make money! I am not too proud to change my mind if the market changes its mind about a company. Do you think a little guy like me is going to argue with the institutions out there?! No way!

Thursday, October 20, 2005

10/20/2005 - WMT strong - shoot

OK - it hurts to be a speculator sometimes. I am missing out on some upward thrusts of WMT since I sold last week. F*&%!. Well, what can I learn from the transaction? First, I have to stop using intraday day data to make decisions when I am using daily close info. If you think about it, the institutions are the one that come in at the end of the day.

Thursday, October 13, 2005

10/13/2005 - WMT weak

Monday, October 10, 2005

10/10/2005 - Dis - What happened?

Dis 10/10/2005

This one did not work out. I thought it was a good trade but as you can see it did not have enough momentun to push it up. Well, it is not my falt that it is did not go up. It would be my fault if I did not do the proper thing and sell.

Discretionary Vs. Mechanical trading. Which do you like?

Cut losses stupid!

Friday, September 30, 2005

09/30/2005 - Dis looks good!

Thursday, September 22, 2005

09/22/2005 - Down Down Down

Looking at the charts of the Dow I see a lot of selling going on! I thought Wall Street expected the 25 basis pt rate hike. Maybe Mr. G is trying to nip this housing boom in the bud. True oil is at $67/barrel and we have another hurricane coming to the US.

I am still in oil but I have raised cash recently. Keeping an eye on stocks to REBOUND! They are still going down now!

I am still in oil but I have raised cash recently. Keeping an eye on stocks to REBOUND! They are still going down now!

Wednesday, September 21, 2005

09/21/2005 - sold C

I sold C today. I was caught between feelings of sell or hold. Unfortunately the market does not care if you are undecided or don't know what you are doing. It will slam you no matter what. On one hand Citi is trying to turn itself around. However, rates are rising, which is a negative for banks. I sold and took a small profit.

Tuesday, September 20, 2005

9/20/2005 - Wal-Mart

Monday, September 19, 2005

09/19/2005 - C

Citi 9/19/2005

This trade is working out OK. You may recall that I bought Citi a couple weeks back but sold out b/c it did not look like it was going to work out. Well, I bought it back and this time it worked. The one thing that I have learned is to cut losses and let profits ride. So, I will let C move up on its own until it tells me that it is tired and rolls over and goes back to bed.

Friday, September 09, 2005

09/09/2005 - This stock is a waste

of time. CAFE is down $0.93 this morning. Everyday there is a news blurb about this company. Today, the NASDAQ is going to delist the shares and warrants. Also, there is so much banter on the message board that my head is spinning. OK, here is probably what was going on with the recent increase in the stock price. The shorts knew that the stock was going to be delisted so they had to buy back shares to cover their positions. This action would drive the stock up. Just an idea.

Wednesday, September 07, 2005

09/07/2005 - CAFE - What?

I hate to say this but I bought some CAFE today. You know, that stock that went from $3 to $15 and then was halted for a couple weeks. It started trading and went down to $3 again. This AM is started to move again and it showed some strength! I did pick some up at $3.28 and SOLD at $3.70. It was actually a stupid move. Lucky to make money on that one.

Bought back into Citigroup again. I bought at $44.19. Stock is showing strength again. Hoping the Fed keeps rates the same and that the new CEO makes profitable changes. Lets see!?

What else happened?

oil (-$1.68 to $65.03/bbl)

With respect to individual equities, there were notable upgrades today for three Dow components that have lent a measure of support to the broader market... To that end, McDonald's (MCD 33.27 +0.61) went to Outperform from Peer Perform at Bear Stearns, while Piper Jaffray upped JP Morgan (JPM 34.79 +0.22) to Outperform from Market Perform and UBS upgraded Hewlett-Packard (HPQ 27.55 +0.30) to Buy from Neutral...

1-week

Top Performer

DJ US Heavy Construction Index (CON)

Last: 244.11

Percent Change: -0.27%

1-month

Top Performer

DJ US Consumer Electronics Index (CSE)

Last: 696.41

Percent Change: -0.99%

6 month

Top Performer

DJ US Water Index (WAT)

Last: 754.02

Percent Change: 0.73%

YTD

Top Performer

DJ US Coal Index (COA)

Last: 265.29

Percent Change: 0.74%

Bought back into Citigroup again. I bought at $44.19. Stock is showing strength again. Hoping the Fed keeps rates the same and that the new CEO makes profitable changes. Lets see!?

What else happened?

oil (-$1.68 to $65.03/bbl)

With respect to individual equities, there were notable upgrades today for three Dow components that have lent a measure of support to the broader market... To that end, McDonald's (MCD 33.27 +0.61) went to Outperform from Peer Perform at Bear Stearns, while Piper Jaffray upped JP Morgan (JPM 34.79 +0.22) to Outperform from Market Perform and UBS upgraded Hewlett-Packard (HPQ 27.55 +0.30) to Buy from Neutral...

1-week

Top Performer

DJ US Heavy Construction Index (CON)

Last: 244.11

Percent Change: -0.27%

1-month

Top Performer

DJ US Consumer Electronics Index (CSE)

Last: 696.41

Percent Change: -0.99%

6 month

Top Performer

DJ US Water Index (WAT)

Last: 754.02

Percent Change: 0.73%

YTD

Top Performer

DJ US Coal Index (COA)

Last: 265.29

Percent Change: 0.74%

Tuesday, September 06, 2005

09/06/2005 - Recaps - - -

Host America (CAFE) has started to trade again as of last week. You may have read some commentary in my past postings. Well, all is not well at CAFE. The stock is trading at about $3 down from the mid-teens. I am grateful that I did not buy any hoping for the greater fool theory to work out for me.

CAFE

Dominos Pizza has trading down since I sold too. I was surprised that the stock dod not move when it had great earnings out last quarter. I did not to wait to find out what the real story was about while holding on to the shares.

I hope all had a great summer. I know I did and I am sorry to see the summer sky change to autumn. I was lucky to get to Pocasset, Cape Cod a few time and do some fishing. My total catch YTD is three Blues and one Striper. I hope to get out a couple more times while the fish are starting their migration to North Carolina.

CAFE

Dominos Pizza has trading down since I sold too. I was surprised that the stock dod not move when it had great earnings out last quarter. I did not to wait to find out what the real story was about while holding on to the shares.

I hope all had a great summer. I know I did and I am sorry to see the summer sky change to autumn. I was lucky to get to Pocasset, Cape Cod a few time and do some fishing. My total catch YTD is three Blues and one Striper. I hope to get out a couple more times while the fish are starting their migration to North Carolina.

Thursday, August 25, 2005

08/25/2005 - Shoot!

Well, --- I got out of Citigroup. I thought we were onto something here. The stock picked it head up last week and showed some strength. This week, not so. Looks like investors are not sure about the new leader at C. We all know how the Market hates uncertainty. True, change is sometimes good but on Wall Street, investors want to get a good idea about the direction a company will take. That is where we are now. I am not in the "hoping" business. I sold with a small loss and will go in again if things look better.

Tuesday, August 16, 2005

08/16/2005 - What I think now.

OK, DPZ is showing weakness. I sold my position. It may be basing but I have a 25% gain and will lock into that now.

MOT id showing weakness. I sold my position for a small gain. 22$ a share was a magic number for that company. The stock had a nice run up the prior weeks. Can't go like that forever.

C, I like this company and bought at $43.73. Stock is showing some good strength the past few days.

MOT id showing weakness. I sold my position for a small gain. 22$ a share was a magic number for that company. The stock had a nice run up the prior weeks. Can't go like that forever.

C, I like this company and bought at $43.73. Stock is showing some good strength the past few days.

Wednesday, August 10, 2005

08/10/2005 - Citigroup and DPZ

C

Citigroup has hit a major support point. It will be interesting to see what happens here. If C goes any lower new support will be established. I would like to see the stock pick its head up and pop a few points. I am keeping an eye on this one.

DPZ

So what do you think will happen to DPZ? The stock had great earnings last qtr yet the Street did not reward it at all. I know, disappointing. I think the Street is waiting to see what mgmt has up its sleeve to keep earnings going. I know Bain Capital probably went in and has expanded the margins the best they could by tweaking the technology and maybe negotiating with suppliers. We have to see how DPZ comes up with new ideas to create more sales. Will they start serving breakfast in bed? Will they make hot dogs and cheese burgers? Beats me?

Thursday, August 04, 2005

Wednesday, August 03, 2005

08/03/2005 - You gotta love this Market!

The one thing that you can count on is that you can never figure out how the Market will react, at least I can't. What am I talking about? Lets talk about two live examples, DPZ and MOT.

DPZ came out with great earnings for the last qtr and what did the stock do? Went down. On the other hand, analysts are telling us that MOT is fairly valued at $21., yet the stock keeps going up.

You can't do anything about it but you have to be open minded to succeed in the Market.

From the Yahoo Message Board, a chap wrote:

They guided down on the full year. With the new regulations of FD (Full Disclosure), the Street reacts more to guidance then quarterly results. Prior to FD, the quarterly results drove price increases and guidance was the extra push, assuming that it was positive. If it was neutral, the Street knew that it would have access to feret out results during the active quarter. That's all changed now.

Makes sense to me. The company said they will have earnings of 13-15%. The PE is at 25. Could be price a little high. Lets see what happend tmwr!

DPZ came out with great earnings for the last qtr and what did the stock do? Went down. On the other hand, analysts are telling us that MOT is fairly valued at $21., yet the stock keeps going up.

You can't do anything about it but you have to be open minded to succeed in the Market.

From the Yahoo Message Board, a chap wrote:

They guided down on the full year. With the new regulations of FD (Full Disclosure), the Street reacts more to guidance then quarterly results. Prior to FD, the quarterly results drove price increases and guidance was the extra push, assuming that it was positive. If it was neutral, the Street knew that it would have access to feret out results during the active quarter. That's all changed now.

Makes sense to me. The company said they will have earnings of 13-15%. The PE is at 25. Could be price a little high. Lets see what happend tmwr!

Tuesday, August 02, 2005

08/02/2005 - DPZ

08/02/2005

You may remember my posting about DPZ in April. The stock has had a nice move up so far. It is up about 25% since I mentioned it. I think this stock is forming a base now. I do not want to make any quick moves but I am keeping and eye on DPZ. Is it basing or losing steam?

Monday, August 01, 2005

08/01/2005 - OTEX - strength?

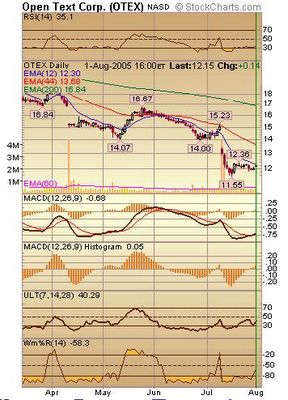

08/01/2005

OTEX, stock is showing strength. Too early to tell how much strength there is though. Keeping an eye on this one though. Sell poiunt on this would be at about $11.65.

MOT seems to be doing OK after BOA's downgrade. The stock was up $.34 today. BOA really did not say anything. They must have had a deadline to publish a report and they could not come up with anything to say.

Friday, July 29, 2005

07/29/2005 - Did someone just flip the lights?

You know when you are at a bar and the manager flips the lights off and on to signal last call.?. I am wondering if Bank of America is pulling this event with MOT. Now, in the bar people do not all rush out the door. Some people stick around and finish their drinks. Still, others belly-up to the bar and order another drink.

I have never really witnessed and upgrade or downgrade affect a stock - long term. Plus, the big guys are buying MOT - they move the stock and they have their own analysts. So, the BOA downgrade may take a little wind out of its sails but I don't THINK it should destroy the beautiful uptrend that we are seeing.

I hope...

I have never really witnessed and upgrade or downgrade affect a stock - long term. Plus, the big guys are buying MOT - they move the stock and they have their own analysts. So, the BOA downgrade may take a little wind out of its sails but I don't THINK it should destroy the beautiful uptrend that we are seeing.

I hope...

Thursday, July 28, 2005

07/28/2005 - MOT - All aboard!

07/28/2005

I was looking at the chart of MOT last night and it caught my eye. Also, from all that I have been reading MOT is a Wall Street darling. The wagon is already moving but I think it may still have some momentum. I like that fact the MOT is developing new technologies that nobody really knows about. In other words, there is a pie in the sky mentality out there. So that should be worth a couple more layers of froth. All aboard!

Wednesday, July 27, 2005

07/27/2005 - A couple hits...

07/27/2005

Well, it is summer time in Boston and you know what that means. It's hot and humid and hazy. When that type of weather hits the town I like to escape to Cape Cod and take respite from the oppressive heat. I went down last night and tried a few casts behind Bassetts Island. Not much luck though, a couple hits. They looked like stripers. I was using surface lures and really going for Blue Fish. The tides was not with us either. Better luck next time.

Sunday, July 24, 2005

07/24/2005 - I thought so...

So the SEC has halted the trading of CAFE. I am not really surprised. You read my post a week back? It just seems strange that CAFE could buy this company called GlobalNet that has this great technology that can save companies huge amounts of money on their electric bills. Why would GlobalNet sell out? We will see what happens on August 5th. Stay tuned.

Thursday, July 21, 2005

07/21/2005 - AMAT and the others - where is the $$$?

7/21/2005 - AMAT

Every now and then I sit back and think about the days when one could make a killing in the semiconductor equipment sector. You would buy when earnings sucked and held until things just could get any better and your aunt was talking about how she just bought 75 shares of Applied Materials. Ah to be young again.

Well, I know I am not the only investor to feel this way. However, are the semi cap equip cos coming back to life or is this just another head fake? Too early to tell but I don't want to miss the ride. Wake me if I happen to fall asleep!

Wednesday, July 20, 2005

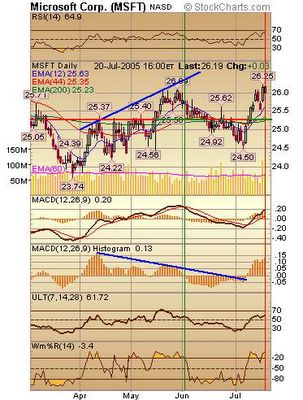

07/20/2005 - MSFT - Lessons Learned Good

MSFT 7/20/2005

I sold out of MSFT today. You may recall that I bought some the beginning of June. I marked the chart where I bought and sold.

My basic idea was to buy on the pull-back to the 13 week EMA. I did that OK. However, I bought when the momentum was still moving down. Big mistake. It all looks so clear today. Well, it was a lesson learned. So, buy when the weakness is over and strength is moving the stock up.

Out with a small profit. Still alive.

07/20/2005 - Ugly Americans

I just finished reading Ugly Americans last night. The book was an entertaining read, no doubt. I did feel duped though. If any of you have read Bringing Down the House, you would know whyI feel this way. Both books are written by the same author, Ben Mezrich. He basically took the same story from his first book and shifted it around a bit and came up with Ugly Americans. OK, it was entertaining, which was all I wanted. A good summer read nonetheless.

Tuesday, July 19, 2005

07/19/2005 - DIS is out

Well, DIS was sold this AM. The stock is showing more weakness and I can't afford to hold onto companies that could take years to come around. My strategy is to get in after weakness, ride strength and sell upon new weakness. So, that is what just happened. Small profit. Still alive.

Monday, July 18, 2005

07/18/2005 - BA is weak

BA 7/18/2005

Wow, it is July 18th already! Can you believe how fast the time goes by during the summer months? February in Boston can last about three months. July and August last about a week.

Looking at the BA chart and it does not look very strong. It is not a long and I would short it if I had more capital.

DIS showed another weak day. Lets see what happens tmrw. If there is more weakness we will have to dump this and regroup.

Friday, July 15, 2005

07/15/2005 - TGIF

The Market seems pretty happy about the news that has been released. DIS continued its move up today. I wish that HPQ came back a bit but I don't think it is going to happen.

CAFE moved up again! I still would not touch it with a ten foot cattle prod, plus buying a stock like this does not fit in my methodology.

So, we keep DIS until it tells us otherwise.

CAFE moved up again! I still would not touch it with a ten foot cattle prod, plus buying a stock like this does not fit in my methodology.

So, we keep DIS until it tells us otherwise.

Wednesday, July 13, 2005

07/13/2005 - WOW look at CAFE!!!

HOST AMERICA CORP is going up up and away! As a greedy SOB I want to buy it but as a business man I have to stay away. There has to be some miscommunication here. You read about all these technologies in magazines yet this one seemed to have missed them. Something does not add up. Of course I would not be saying this if I bought at $3.

I did buy some DIS today at $25.51. Stock looks undervalued on technicals and the Company could be planning some strategical moves.

I did buy some DIS today at $25.51. Stock looks undervalued on technicals and the Company could be planning some strategical moves.

Tuesday, July 12, 2005

07/12/2005 - PEP revisited

7/12/2005

I was curious how some of my predictions have worked out. Here is one you may recall concerning PEP. This was a classic Bearish Divergence. The stock was moving higher but the MACD stalled out. You can see the correction that took place.

Friday, July 08, 2005

07/08/2005 - HPQ - sneak attack

HPQ 7/8/2005

I have had my eye on this stock for a while, ever since Carley was asked to leave. At least she got some experience doing a major acquisition. It will look good on her resume.

You can see that there is a long term up trend in place currently. I am reminded of Intel when I look at this chart. Intel showed some strength for a while and then went north for a few weeks. Of all the Dow stocks, this one is my favorite right now.

Thursday, July 07, 2005

07/07/2005 - Hello!

Oh, it has been a long time since I last penned a posting. I can explain. I have two reasons for my hiatus. First, I am in real estate and it has been busy this summer. Also, I have not been doing much in the Market. So there you have it.

What about this housing bubble? Many people have asked me about the subject. I don't know the answer. Hey, check out this site. It is called "Condo Flip."

http://www.condoflip.com/

Condo Flip™ is an online marketplace where buyers, flippers (sellers), brokers, real estate agents, developers and builders can interact with each other and exchange preconstruction condo properties.

What about homeowners?

It seems like the real estate market is acting pretty normal. I don't see any speculation, do you?

What about this housing bubble? Many people have asked me about the subject. I don't know the answer. Hey, check out this site. It is called "Condo Flip."

http://www.condoflip.com/

Condo Flip™ is an online marketplace where buyers, flippers (sellers), brokers, real estate agents, developers and builders can interact with each other and exchange preconstruction condo properties.

What about homeowners?

It seems like the real estate market is acting pretty normal. I don't see any speculation, do you?

Friday, June 17, 2005

06/17/2005 - OoOps!...

MSFT

I bought some "Big Green" the other day. I thought it was a good move. The stock was pulling back to its 13 day EMA. What went wrong. Well, I should have waited for it to start moving back up before I placed the order.

My readers know that I don't just post the good stuff. Here is a good example of ideas going the wrong way. Hey you can't win 'em all. My saving grace is that MSFT shouldn't be going out of business. I just did not catch this right.

DPZ

I am still holding onto DPZ. I think this one should creep up some more.

Tuesday, June 14, 2005

06/14/2005 - INTC

I was reading the Journal last week and they had a nice article how INTC's revenues are going to be up. If you looked at the chart of INTC, it was telling us something for the last couple weeks before the WSJ came out with this report. Who knows, maybe it was telling us about Apple's plans to use their chips? Anyway you slice it, the chart was telling us something before the news article came out in the WSJ. I know what you are saying, "tell me something I don't know." Put it this way - let me show you what happened after the news came out:

INTC 06/14/2005

Now, who bought the stock after the news came out? Is the run over now?

INTC 06/14/2005

Now, who bought the stock after the news came out? Is the run over now?

Wednesday, June 08, 2005

06/08/2005 - Hello / Whats' new?

Gosh, it has been awhile since I last wrote in this blog. I have just been busy with my full time job - real estate. What are your thoughts on the real estate bubble? I was reading the New York Times and the writer said that if you wanted to compare the real estate bubble to that of the NAZ, we would be at about the 3000 mark. Still some room to the upside.

I have a beautiful one Bedroom for sale in the Back Bay of Boston. Great city views and sunny! - asking $375K. Great for an investment or to live in.

I have a beautiful one Bedroom for sale in the Back Bay of Boston. Great city views and sunny! - asking $375K. Great for an investment or to live in.

Saturday, May 28, 2005

5/28/2005 - MSFT is creeping - Drugs Stocks???

MSFT 5/29/2005

I was looking at some charts yesterday and noticed that MSFT is moving up quietly. It broke out of resistance last week and is above its 12 day EMA. The weekly chart shows that MSFT is trending up too. It would be nice to see MSFT come back to its 12 day EMA and be able to buy some shares. If it acts like INTC we won't have a chance to get in before the blast-off.

What the hell is it with these drug companies? Investing in these issues is like walking over an Iraqi minefield (I think, I have never been to Iraq but I saw some pics in National Geographic). Just as I was looking at Pfizer, a press release comes out about Viagra causing blindness. The stock sinks on worries of litigation and possible earnings collapse. My late uncle Alex, who was a great business man, would always invest in the top blue chip companies like a Pfizer, Intel or Coke. I wonder if he would still care to invest in big pharmaceutical companies in 2005. Drug companies are a tricky group these days. Are they worth the risk?

Thursday, May 26, 2005

05/26/2005 - INTC and Pfizer - sneaky stocks

Hey, have you noticed INTC and PFE? These stocks are moving. I had my eye on them but they are getting away. Take a look at INTC's chart! I am waiting for this to come down a bit but she won't budge - just goes higher and higher. I would buy but I know the stock will come down after my order gets filled.

I am now looking at HPQ, Big Green and Mickey. I hope I don't fall asleep at the wheel on these stocks.

I am now looking at HPQ, Big Green and Mickey. I hope I don't fall asleep at the wheel on these stocks.

05/26/2005 - PEP out of gas?

Wednesday, May 25, 2005

05/25/2005 - The size of a milk carton

I was thinking about Michael Lewis's book, Money Ball the other day. I don't recall the words verbatim but I think it was around page 145 in the paperback when he wrote about pitching to Jason Giambi. To summarize, Jason has a weak spot in his strike zone where pitchers can get him. The spot is the size of a pint milk carton. However, if Jason can see this pitch coming he steps out of his stance and fowls off the pitch. He is still alive. If the pitchers miss this weak spot, watch out because Jason will crush the pitch!

So, my point is that when you are in the markets you are competing with the Jasons and MLB pitchers of investing. Be careful or you will get crushed! You have to be certain why you are putting on a trade and not just hoping.

So, my point is that when you are in the markets you are competing with the Jasons and MLB pitchers of investing. Be careful or you will get crushed! You have to be certain why you are putting on a trade and not just hoping.

Saturday, May 21, 2005

5/21/2005 - PFE - INTC

It was a pretty good week for stocks last week. I hope you covered your AAPL short. I like PFE and INTC for entering long positions. I would not do so yet since these stocks are up well over their 12 day EMA.

DPZ continues to move. It is pretty over extended and will probably stall in the short-term.

DPZ continues to move. It is pretty over extended and will probably stall in the short-term.

Tuesday, May 17, 2005

5/17/2005 - GLW sold

I sold my GLW @ $14.70. Not too sure whats going on with this stock. Safe to cash out with a profit. The stock is trading at $14.50 (at its 12 day EMA). On the technical side there is a little value here but I am worried there may be more fallout.

INTC and PFE have not move down enough for me to buy. Still watching these stocks.

INTC and PFE have not move down enough for me to buy. Still watching these stocks.

Saturday, May 14, 2005

05/14/2005 - A couple ideas

Recently I have seen Intel and Pfizer start to move up. Now I have been faked out by Pfizer in the past but this time it looks like it showing a bit more strength. I am not doing anything right now but if these stock pull back to their 13 day EMA, I may purchase some. More later...

Tuesday, May 10, 2005

5/10/2005 - DPZ (more than pizza)

DPZ 5/10/2005

DPZ came out with earnings better than expected. I was reading the boards and you have people talking about the taste of pizza and how unhealthy it is. They don't see why the stock should go up. Management is the reason for DPZ's success. Like I said before, you have a big VC firm holding onto a bunch of stock. These guys play for keeps. Yeah, DPZ is not a new technology or drug. However, why would Bain Capital hold so much equity if they did not think more value could/would be created in the future? Yesterday's conference call sounded upbeat. Lets hope margins continue to rise - along with the stock price!

Thursday, May 05, 2005

GLW - GLoW - worm

GLW 5/4/05

I owned GLW about two years ago. I saw that Dan Fuss of Loomis Sayles was buy the debt and I figured the company was not going out of business. So I bought the equity around $5 and sold around $12. Well, I am back in again. I believe in this company's management. They are good at reinventing themselves. They are doing it again with flat screen TVs, making the glass that is. They are one of four companies that make the glass, in the world. The stock recently broke out of its trading range. The 26 week EMA is moving up. People are talking about this one and starting to buy.

Tuesday, May 03, 2005

05/02/2005 - AAPL again

OK, the Tiger OS is out now. Apple is upgrading their machines. The stock has not done too much. The Wall Street rule is that all stocks trade based of future expectations. So my questions deals with the future of AAPL. I am not talking about the company here. We all know the company and stock price are two different animals. They are related but rather loosely. AAPL is a great company I won't argue but can the stock go up further?

Friday, April 29, 2005

Genworth - good but sold

GNW 4/29/2005

You know, I like GNW. I wanted to see this sucker go up to $35. However, I saw something today that made me a little nervous. You see where that red circle is up there on the chart. Too choppy for me. The price is flirting with the 50 Day MA. The stock does not know what it wants to do. I would rather stand on the sidelines and wait for it to figure this out then hold on and cross my fingers. I sold, made a tiny profit.

Corning (GLW) - sold off huge today but came back to finish about flat for the day. That shows some pretty good strenth. I expect this stock to creep up over the next couple months. The stock had done nada for a long time but finally broke out of a trading range. Espect good things as a result.

Thursday, April 28, 2005

PIR & HAWK updates - going down down down

PIR

I remember talking about PIR earlier and things are pretty much turning out as I expected. Actually, I am a little surprised that PIR has not done better given that Warren Buffett's company owns some of the equity. Well, maybe I am right about the Target theory (you can buy the same crap in Target... at a lower price.)

HAWK

Remember, I spoke about the bearish divergence? The stock is sinking, which is not surprising. The stock just did not have the power to move it forward. The institutions came in but even they could not move this puppy up. It was good that I sold...

I am short on apples!!!

AAPL 4/27/2005

A good buddy of mine just bought an iPod. He is pretty tech savvy but not one to buy into fads. So when I saw him go out and buy one of these memory machines, I knew that the iPod must be "mainstream." So, what does Apple have up its sleeve now? Some kind of new computer called the Tiger? I actually don't know and you probably are correct in telling me to shut-up. However, do you remember when AAPL was a computer company (only), before the iPod? Do you remember what the stock was trading at? $13-14 a share. So, now that the iPod run is over, AAPL is back to computers. I wonder where the stock price will go?

I shorted this at $36.55. So, I don't think this sucker is going up.

Friday, April 22, 2005

4/22/2005 - AIG yes... NO. not yet.

AIG 4/22/05 daily

4/22/05 AIG weekly

I was looking at AIG the other day and it looked pretty interesting. The daily chart looks like a bulling divergence. The stock was making recent new lows but the MACD Hist was above the 0 line. However, the weekly chart did not show that bullish divergence. It shows a much different story. The MACD hist was making a new low! I would not buy now. I was close though.

Any thoughts?

Thursday, April 14, 2005

04/14/2005 - HAWK - update

04/14/2005 - AAPL - update

AAPL 4/14/2005

You may recall that I had a broker call me trying to sell me AAPL reverse convertible bonds. I politely declined. I just could not see AAPL continuing its climb that it has had over the last couple years. The broker even said that the retailers are expecting iPod to sell briskly through the summer. What? Was I born yesterday? If the retailers are expecting it, I am sure Wall Street is too. Nice try.

You could see this stock cracking from a mile away. Today, the stock trades below its 50 MA. Sure the stock may bounce up a little but I think the street is waiting for AAPL's next rabbit trick. I know I am...

04/14/2005 - Pier 1 - update

Pier 1 Imports - 4/14/2005

You may have remembered that I wrote about (PIR) a while back. I actually owned it because I saw that Berkshire owned some. I then sold the stock for a couple reasons. First, buying a stock because someone else has is not smart. Also, the stock was in a trading range for a while. So, I sold. I am looking at a current chart and it looks like I made a good choice. PIR has had a hard time convincing investors that their new strategy is going to work. As I said before, can't you buy the same crap in Target?

Thursday, April 07, 2005

04/07/2005 - DPZ > > > ME hungry!

DPZ is looking like it is making a move to another upward trend. The stock was over the $19. mark today, an area where it was getting a lot of resistance. Bain Capital still holding a lot of stock. I can't imagine Bain wanting to lose money on this (or anything else they do). They want to see this go up. I can't think of too many other coattails with similar success stories as Bain Capital. I like the stock now.

Wednesday, April 06, 2005

04/06/2005 - What's up with this?

04/06/2005 - Bearish Divergence = Sell

Tuesday, April 05, 2005

04/05/2005 - My Complaints Today

I don't know what is going on with HAWK. Looking at the chart, it does not look too strong. Tomorrow will be interesting. If the stock shows more weakness, it may be time to dump it and wait for it to start showing strength.

DPZ is inching up - slowly. I would buy this stock if it had more volume to it. I just don't see institutions buying yet and they move stocks.

GNW is moving up slowly. Lets be patient and hold on to this one.

DPZ is inching up - slowly. I would buy this stock if it had more volume to it. I just don't see institutions buying yet and they move stocks.

GNW is moving up slowly. Lets be patient and hold on to this one.

Friday, April 01, 2005

04/01/2005 - Good Day in the Oil Patch

Hello,

Well, HAWK moved up $1.05 to $11.53. Goldman came out saying oil could hit $105. Also, HAWK is making money right now. You saw in my earlier chart how it looked like the institutions were buying. Lets hope that continues!

GNW was up $0.09 today to $27.61.

DPZ, was down a bit. How is Bain Capital going to dump its shares with such low volume. Once the volume comes, this stock may move fast. I don't see it yet...

Well, HAWK moved up $1.05 to $11.53. Goldman came out saying oil could hit $105. Also, HAWK is making money right now. You saw in my earlier chart how it looked like the institutions were buying. Lets hope that continues!

GNW was up $0.09 today to $27.61.

DPZ, was down a bit. How is Bain Capital going to dump its shares with such low volume. Once the volume comes, this stock may move fast. I don't see it yet...

Tuesday, March 29, 2005

3/29/2005 - Dr. Alex Elder Webnar - Good Time!

DJIA 3/29/2005

I participated in a webnar with Dr. Alexander Elder today. I enjoyed it very much. Actually, this was my first webnar ever. The above chart shows the weekly graph of the DJIA, showing a Bearish Divergence! Needless to say, Dr. Elder is bearish now. I believe John Murphy is bearish too. I guess they are seeing the same things.

Here is how Elder views markets now:

Oil - Bullish long-term (start buying oil if it hits $50. on the next dip)

Interest Rates - going up

US Dollar - going up

Euro - going down

Stock Market - going down

housing stocks - short

Books Elder recommended:

Elder's Books

Hubbert's Peak : The Impending World Oil Shortage

The Disciplined Trader: Developing Winning Attitudes

I picked up some Genworth (GNW) at $26.78. I would like to see the stock get up to its 20 day EMA. The stock still has some room to move.

Friday, March 25, 2005

03/25/2005 - Genworth

Tuesday, March 22, 2005

03/22/2005 - Pizza anyone?

Friday, March 18, 2005

03/18/2005 - PIR ??? What's the rush?

03/18/2005 - PIR

Pier 1 (PIR) is getting a lot of press these days. I don't know if you have noticed. The NYT had an article about how PIR pulled their ad campaign last season and now they are revamping the stores to make them less cluttered. A new ad campaign will be introduced too.

Looks like the institutions are taking a wait and see attitude. The stock is down over the last couple of days. I would not take this stock seriously until it starts trading over $19.97. It could make a quick move if it does hit that area.

It is a make or break time for PIR. They have had more excuses for their bad perfomance over the last year. I would think that management's credibility is starting to wear and tire the analysts and investors. Maybe the business model does not work anymore. Did anyone think of that? I mean, can't you buy the same crap at a Target or Wal-Mart? - and for less?

Wednesday, March 16, 2005

03/16/2005 - MIT discussion group

Good morning. Last week I told you that I was going to a discussion over at MIT concerning technical analysis. Specifically, Joseph E. Majocha was going to speak about his website Selective Chartists.

In general I thought Joe had some good stuff to say. I give him credit for getting up in front of, what I thought were, some pretty confident and cocky people. There was one older man named Herb who was basically giving Joe a tough time. One time he asked Joe where Martha Stewart would have sold. Joe did not answer but I could not restrain myself. I chirped out, "the top!"

The one thing that I got from this meeting was that there is no magic bullet. We all have the same tools. We may interpret information differently, which is what separates those who make money from those who don't.

The other point that Joe said, but went unnoticed, was that he cut his losses quickly. Preserve your capital and get another chance to make money. Let's face, not all trades will be winners.

In general I thought Joe had some good stuff to say. I give him credit for getting up in front of, what I thought were, some pretty confident and cocky people. There was one older man named Herb who was basically giving Joe a tough time. One time he asked Joe where Martha Stewart would have sold. Joe did not answer but I could not restrain myself. I chirped out, "the top!"

The one thing that I got from this meeting was that there is no magic bullet. We all have the same tools. We may interpret information differently, which is what separates those who make money from those who don't.

The other point that Joe said, but went unnoticed, was that he cut his losses quickly. Preserve your capital and get another chance to make money. Let's face, not all trades will be winners.

Tuesday, March 15, 2005

03/15/2005 - HAWK

Petrohawk Energy Corp. 3/15/2005

This company looks interesting. It reminds me of a company you would see in IBD where there is no volume for a point in time and then the institutions discover it. It looks like there are some buyser here. I also see the 27% of the company is still owned by insiders. Finished up today.

Saturday, March 12, 2005

03/12/2005 - The Coming Week

I am excited for next Tuesday (the 15th). MIT is hosting a discussion on technical analysis. I will let you know how it goes.

I have recently sold EPD and FCL. I was very happy with the results. FCL sold with a 25.5% gain and EPD with a 20% gain. Both stocks were held less than a year. Energy picks are getting difficult. Many issues have moved up quite a bit over the last year. You don't want to get caught playing the "greater fool" game. I don't anyway.

I have scaled back on my trades. GM catches my eye. I would not want to catch a falling knife but this stock has potential to start moving up again.

I have recently sold EPD and FCL. I was very happy with the results. FCL sold with a 25.5% gain and EPD with a 20% gain. Both stocks were held less than a year. Energy picks are getting difficult. Many issues have moved up quite a bit over the last year. You don't want to get caught playing the "greater fool" game. I don't anyway.

I have scaled back on my trades. GM catches my eye. I would not want to catch a falling knife but this stock has potential to start moving up again.

Thursday, March 10, 2005

03/10/2005 - EPD sold for 25.5% gain

OK, you guessed by the title of today's posting that I sold EPD at $26.50. I bought the stock at $20.29, 278 days ago. I am pleased with the return. The stock seems to have stalled. They keep fooling around with their capital structure which worries me. They may know what they are doing but I don't.

Wednesday, March 09, 2005

03/09/2005 - iPod Stock

I received a call the other day from an investment advisor pitching me reverse convertible bonds for Apple Computer. Basically, I would receive a 12% coupon and get my principle back if AAPL stock stays above a certain price. If the price falls however, I receive a stated number of shares. That is where I could get killed. I knew I did not like the idea but I said I would call the guy back later.

I called the guy back and told him I didn't like the idea. I mean AAPL has been going up for the last couple years. The only way I see this stock going up or even keeping its value is if the company comes out with a great new product. I am surprised that the investment advisor would try to pitch such a crazy idea. I could be wrong on this one but I am willing to take that chance. I could have used his advice to buy the stock when it was at $12!

I called the guy back and told him I didn't like the idea. I mean AAPL has been going up for the last couple years. The only way I see this stock going up or even keeping its value is if the company comes out with a great new product. I am surprised that the investment advisor would try to pitch such a crazy idea. I could be wrong on this one but I am willing to take that chance. I could have used his advice to buy the stock when it was at $12!

Monday, March 07, 2005

03/07/2005 - The Rector of Justin

I try to read other books than those about finance. I am just finishing up The Rector of Justin, a great book by Louis Auchincloss. Mr. Auchincloss is a self acclaimed "hack" as a lawyer but a fabulous writer. The Rector of Justin is about an all boys prep school, thirty miles west of Boston. I think the book is loosely based on the Groton School in Groton Mass and the Rev. Peabody. The book takes place in the 1940s. Great book. One quote from the book that I thought was funny was:

"Yes, greatness of the private school, Brian, is not that it produces geniuses - they grow anyway, and can't be made - but that it can sometimes turn a third-rate student into a second-rate one."

I find it funny because I went to an all boys private school (that competed with Groton in athletics) and I find the quote to be pretty much true. Ha hah hah!

"Yes, greatness of the private school, Brian, is not that it produces geniuses - they grow anyway, and can't be made - but that it can sometimes turn a third-rate student into a second-rate one."

I find it funny because I went to an all boys private school (that competed with Groton in athletics) and I find the quote to be pretty much true. Ha hah hah!

Friday, March 04, 2005

03/04/2005 - FCL Sold

I sold Foundation Coal today at $26.81. I bought this stock at $22.37 for a 20% increase over a 78 day holding period. I like it.

Thursday, March 03, 2005

03/03/2005 - Oil and Coal

Hello and thank you for joining me again. It has been a while since I last updated my blog. The reason is the confluence of being away and also not really having anything germane to say about the market.

OK, February was a pretty good month for me but not for the S&P 500 Index Fund (SPY). The SPY returned -0.20%. I am happy to say that I was up about 12% for the month of February. I attribute that gain all to energy stocks in my portfolio. Exxon, Petrochina, Foundation Coal and Enterprise Products have all performed well in February. These companies are in natural gas, oil and coal businesses. As I said earlier, I am not going to toy around too much with these holding now.

I still have some cash to invest so I will be looking for some ideas.

Glad to be back!

OK, February was a pretty good month for me but not for the S&P 500 Index Fund (SPY). The SPY returned -0.20%. I am happy to say that I was up about 12% for the month of February. I attribute that gain all to energy stocks in my portfolio. Exxon, Petrochina, Foundation Coal and Enterprise Products have all performed well in February. These companies are in natural gas, oil and coal businesses. As I said earlier, I am not going to toy around too much with these holding now.

I still have some cash to invest so I will be looking for some ideas.

Glad to be back!

Monday, February 21, 2005

02/21/2005 - Happy President's Day!

You know I often get bogged down with little items about the Market and lose sight of the big picture. Since the beginning of the month, my portfolio has done well. It is all attributed to energy stocks. Exxon and Petrochina have done very well. You may have read the Exxon is now larger than GE in terms of market capitalization. I own two other energy companies that are performing just OK. Enterprise Products and Foundation Coal have done well, but not as good as the oil cos. I am not going to fiddle with this part of my portfolio.

I do have some cash from my sale of NSL and EAD. These funds are interest rate sensitive and took a turn for the worst last week. I was able to dump both funds with a profit plus dividends they paid. It was not a huge killing but not bad for a couple weeks work. I will be on the hunt for new ideas.

Friday's News.....

With respect to the January PPI report, its core component (excludes food and energy), which showed a surprising 0.8% increase versus the consensus estimate that called for a more modest 0.2% increase...

The yield on the benchmark 10-yr note jumped 8 basis points to 4.26% and the yield on the 30-yr bond rose 7 basis points to 4.65%...

I do have some cash from my sale of NSL and EAD. These funds are interest rate sensitive and took a turn for the worst last week. I was able to dump both funds with a profit plus dividends they paid. It was not a huge killing but not bad for a couple weeks work. I will be on the hunt for new ideas.

Friday's News.....

With respect to the January PPI report, its core component (excludes food and energy), which showed a surprising 0.8% increase versus the consensus estimate that called for a more modest 0.2% increase...

The yield on the benchmark 10-yr note jumped 8 basis points to 4.26% and the yield on the 30-yr bond rose 7 basis points to 4.65%...

Wednesday, February 16, 2005

02/15/2005 - Back from VT

Hello and thank you for joining me again. I have been away for a few days. I good friend of mine had his bachelor party up at Killington Vermont. We had a grand old time. I think I am still feeling the effects.

I sold my NSL at $9.69. I am pleased. I was getting a dividend yield of 6% and I also received 5% capital appreciation, which would have been 43% annualized.

Still holding on to EAD. Yield 10%.

Two charts that I have been looking at but probably won't buy because they have gotten away from me are P&G and EBAY. The downtrend on these two charts shows a strong reversal. Too bad I was away.

I sold my NSL at $9.69. I am pleased. I was getting a dividend yield of 6% and I also received 5% capital appreciation, which would have been 43% annualized.

Still holding on to EAD. Yield 10%.

Two charts that I have been looking at but probably won't buy because they have gotten away from me are P&G and EBAY. The downtrend on these two charts shows a strong reversal. Too bad I was away.

02/16/2005 - Sold EAD too!

Yup sold EAD today at $15.29. I am please with the sale. Made a short term gain. The suprise of the day was Foundation Coal (FCL). The earned $.15 a share last qtr. The stock was up about $1.34 today. Lets hope this catches some attention from the institutions.

Tuesday, February 08, 2005

02/08/2005 - Not Much New - What?

I have been on the sidelines lately. I still hold NSL and EAD, both have performed well for me. I am in no hurry to allocate capital now.

John Murphy had some interesting things to say today about interest rates. I was also reading something about interest rates yesterday and the author said that long-term rates are coming down because the Fed is raising short-term rates and thus mitigating inflation long-term.

Every recession in the last forty years has been preceded by an inverted yield curve.

Bond yields fell sharply last Friday on a weak jobs report. Fourth quarter GDP came in way below expectations and was the weakest of the year. That's also pushed yields lower. The fact that bond prices have done better than stocks so far this year also suggests a more defensive attitude on the part of investors. Then there's the impact of falling bond yields on the yield curve.

Energy stocks remain the market's strongest sector -- while technology is the weakest. That's a bad combination for the stock market. The fact that consumer staples and utilities have been market leaders early in the new year (along with energy) is a sign that the economic cycle could be peaking. Then there's the January Barometer which gave a negative vote for the market this year. A little known aspect of January's performance is that sector leaders during January often lead for the entire year. And sector laggards often lag for the balance of the year. That's another vote for defensive market sectors -- especially energy. If rising energy shares are hinting at higher oil prices, that's not going to be good for the rest of the market or the economy. Maybe that's why bond yields are dropping.

The above statements are John Murphy's from Stockcharts.com.

John Murphy had some interesting things to say today about interest rates. I was also reading something about interest rates yesterday and the author said that long-term rates are coming down because the Fed is raising short-term rates and thus mitigating inflation long-term.

Every recession in the last forty years has been preceded by an inverted yield curve.

Bond yields fell sharply last Friday on a weak jobs report. Fourth quarter GDP came in way below expectations and was the weakest of the year. That's also pushed yields lower. The fact that bond prices have done better than stocks so far this year also suggests a more defensive attitude on the part of investors. Then there's the impact of falling bond yields on the yield curve.

Energy stocks remain the market's strongest sector -- while technology is the weakest. That's a bad combination for the stock market. The fact that consumer staples and utilities have been market leaders early in the new year (along with energy) is a sign that the economic cycle could be peaking. Then there's the January Barometer which gave a negative vote for the market this year. A little known aspect of January's performance is that sector leaders during January often lead for the entire year. And sector laggards often lag for the balance of the year. That's another vote for defensive market sectors -- especially energy. If rising energy shares are hinting at higher oil prices, that's not going to be good for the rest of the market or the economy. Maybe that's why bond yields are dropping.

The above statements are John Murphy's from Stockcharts.com.

Friday, February 04, 2005

02/04/2005 - Update

Sorry, I have not been around. I actually have a day job in Real Estate too. So I have been busy with that.

I am pleased so far with my move into the Evergreen Income Adv. The fund is up to $15.76 from $15.20, where I bought. Plus the 11% div yield. Nuveen Sr Incm Fd is doing well too. I am happy with my energy stuff, EPD and FCL. So, I do not have any trade ideas yet. I am still reframing that part of my portfolio.

News today:

- January non-farm payrolls rose 146K, weaker than the 200K economists expected and below an average gain of 177K over the four prior months...

- crude oil prices ($46.48/bbl +$0.03)

I am pleased so far with my move into the Evergreen Income Adv. The fund is up to $15.76 from $15.20, where I bought. Plus the 11% div yield. Nuveen Sr Incm Fd is doing well too. I am happy with my energy stuff, EPD and FCL. So, I do not have any trade ideas yet. I am still reframing that part of my portfolio.

News today:

- January non-farm payrolls rose 146K, weaker than the 200K economists expected and below an average gain of 177K over the four prior months...

- crude oil prices ($46.48/bbl +$0.03)

Wednesday, February 02, 2005

02/01/2005 - Notes

The market was up! Yippie! Let's not get carried away.

First, I would like to say that I am please with the EVERGREEN INCOME ADV so far. The fund is up and yields around 11%. I like those numbers. NUVEEN SR INCM FD is up too from where I bought and yields me 6%. As you can see I have dug my heals in somewhat. I was not clicking with the market when the new year began, so I retreated and reframed the plan.

First, I would like to say that I am please with the EVERGREEN INCOME ADV so far. The fund is up and yields around 11%. I like those numbers. NUVEEN SR INCM FD is up too from where I bought and yields me 6%. As you can see I have dug my heals in somewhat. I was not clicking with the market when the new year began, so I retreated and reframed the plan.

Monday, January 31, 2005

01/31/2005 - Up Today

Hey, the market started off pretty good for the week. Up 62 pts or so. The market reporters said that the market was up because of some good news out on the wire. I guess I am surprised that the market did not do better today. We need help from the institutions if this market is gonna do anything.

- A better than expected 60-75% Iraqi voter turnout that passed without a considerable increase in violence

- OPEC's decision to maintain its current rate of oil production at 27 mln barrels a day

- Homebuilding had been weak following Dec New Home Sales that came in slightly below forecasts (1.09 mln units versus consensus of 1.2 mln),

- Jan Chicago PMI, which showed Midwest manufacturing activity expanded for the 21st consecutive month with a better than expected read of 62.4 (consensus 59.8)

The market needs a lot more good news for it to push forward. Remember, back in the day when a company could say that they did not lose as much as they thought and the stock went up about 40%. How about when an Internet company said they were going to have an increase in "page impressions" or "eyeball traffic" of 25% and the stock went up 50%. Not anymore. Investors are not easily convinced anymore.

- A better than expected 60-75% Iraqi voter turnout that passed without a considerable increase in violence

- OPEC's decision to maintain its current rate of oil production at 27 mln barrels a day

- Homebuilding had been weak following Dec New Home Sales that came in slightly below forecasts (1.09 mln units versus consensus of 1.2 mln),

- Jan Chicago PMI, which showed Midwest manufacturing activity expanded for the 21st consecutive month with a better than expected read of 62.4 (consensus 59.8)

The market needs a lot more good news for it to push forward. Remember, back in the day when a company could say that they did not lose as much as they thought and the stock went up about 40%. How about when an Internet company said they were going to have an increase in "page impressions" or "eyeball traffic" of 25% and the stock went up 50%. Not anymore. Investors are not easily convinced anymore.

Saturday, January 29, 2005

01/28/2005 - More of the same - partie deux

Well, the market ended down. Surprised? I'm not. What happened in the news? Not enough.

- the Q4 employment cost index, which rose a smaller 0.7% (consensus +0.8%), the weakest overall rise since Q2 1999...

- Commerce Dept. showed 3.1% annual growth in advance Q4 GDP, less than the expected 3.5% growth rate, the data still suggest overall GDP growth in 2004 was the most robust since 1999 and still slightly above the 10-year trend...

- The GDP deflator (inflation) rose at a modest 2.0% annual rate, basically in line with economist's forecast of 2.1%...

You know, I have adjusted my game plan. It took me a few losses to get it through my thick skull that most equities are lethal right now. I moved some money into a fixed income mutual fund called EVERGREEN INCOME ADV (AMEX:EAD). Evergreen Income Advantage Fund will invest at least 80% of its assets in below investment-grade (high yield) debt securities, loans and preferred stocks, under normal market conditions. These securities are rated Ba or lower by Moody's Investors Service, Inc. or BB or lower by Standard & Poor's Ratings Group, or are unrated securities of comparable quality as determined by the fund's investment advisor.

The yield on the fund is 11%. I bought at $15.20. Here again, like the Nuveen Senior Income Fund, I don't expect too much capital appreciation or depreciation. My take is that it is not safe to be trafficking in equities now. It is important to keep a close eye on your capital...

- the Q4 employment cost index, which rose a smaller 0.7% (consensus +0.8%), the weakest overall rise since Q2 1999...

- Commerce Dept. showed 3.1% annual growth in advance Q4 GDP, less than the expected 3.5% growth rate, the data still suggest overall GDP growth in 2004 was the most robust since 1999 and still slightly above the 10-year trend...

- The GDP deflator (inflation) rose at a modest 2.0% annual rate, basically in line with economist's forecast of 2.1%...

You know, I have adjusted my game plan. It took me a few losses to get it through my thick skull that most equities are lethal right now. I moved some money into a fixed income mutual fund called EVERGREEN INCOME ADV (AMEX:EAD). Evergreen Income Advantage Fund will invest at least 80% of its assets in below investment-grade (high yield) debt securities, loans and preferred stocks, under normal market conditions. These securities are rated Ba or lower by Moody's Investors Service, Inc. or BB or lower by Standard & Poor's Ratings Group, or are unrated securities of comparable quality as determined by the fund's investment advisor.