I like this company. I bought some today with my "long-term" money. There are a couple things at play here that I like. First, you get exposure to China. Have you seen this company's financials? They look pretty good from where I am standing. No debt, a profit margin of 23%, a dividend of about 3%. That is not too shabby. Also, this is a growth play. The company is investing in its railroad and stations. The population in China is becoming more wealthy with a need to travel and transport cargo. The technicals look "over-bought", but this company keeps making new highs. I like the odds on this one...

Thursday, December 30, 2004

Wednesday, December 29, 2004

12/29/2004 - Re-Cap of Previous Trades in 2004

Hahhhh... Where to begin? 2004 was a good year, not great, but good. I made five trades and a few that I am still holding since I begin keeping this blog. Lets review the damage.

Libbey - bought on 10/1/04 at $18.99 sold at $19.37 current price is $21.52. I did not like holding this stock because its volume was about 50K shares a day. There was a lot of slippage buying and selling this one. Got out with a small profit.

Colgate - bought on 10/20/2004 at $45.35 sold at $46.58 current price is $50.12. I guess I should have held on a little longer. Why didn't I? I expected this stock to move up a little faster. Instead the stock languished and ended up in a trading range. It still is in a range. I was able to get the dividend though. A plus.

Maytag - bought on 10/25/2004 at $16.84 sold at $17.37 current price is $21.00. I was not looking for a big move on this stock. I don't know why I set an expectation on this stock. I have to remind myself to let the stock market decide when I buy and sell. I should have listened to the market closer. I was also concerned about their debt rating, which was lowered.

Aflac - bought on 11/8/2004 at $37.20 sold at $37.01 current price is $40.11. Shoot! Well, you win some you lose some. I made the mistake of selling during the trading day. I try not to do this. I am not a day trader. I try to let the day play out and see what the institutions do in the afternoon. Sure enough, after I sold the stock trended up again. I protected my capital though.

OSI pharmaceuticals - bought on 12/14/2004 at $49.00 sold at $47.53 current price is $73.15! Double ouch! What can I say? This stock was a gamble and I lost. The stock could have gone down $20.00 too. I can't dwell on this one. Look forward not behind.

I still ended up ahead.

A few lessons:

1) Don't traffic in low volume stocks

2) Don't be in a hurry to sell for profits

3) Be patient

Libbey - bought on 10/1/04 at $18.99 sold at $19.37 current price is $21.52. I did not like holding this stock because its volume was about 50K shares a day. There was a lot of slippage buying and selling this one. Got out with a small profit.

Colgate - bought on 10/20/2004 at $45.35 sold at $46.58 current price is $50.12. I guess I should have held on a little longer. Why didn't I? I expected this stock to move up a little faster. Instead the stock languished and ended up in a trading range. It still is in a range. I was able to get the dividend though. A plus.

Maytag - bought on 10/25/2004 at $16.84 sold at $17.37 current price is $21.00. I was not looking for a big move on this stock. I don't know why I set an expectation on this stock. I have to remind myself to let the stock market decide when I buy and sell. I should have listened to the market closer. I was also concerned about their debt rating, which was lowered.

Aflac - bought on 11/8/2004 at $37.20 sold at $37.01 current price is $40.11. Shoot! Well, you win some you lose some. I made the mistake of selling during the trading day. I try not to do this. I am not a day trader. I try to let the day play out and see what the institutions do in the afternoon. Sure enough, after I sold the stock trended up again. I protected my capital though.

OSI pharmaceuticals - bought on 12/14/2004 at $49.00 sold at $47.53 current price is $73.15! Double ouch! What can I say? This stock was a gamble and I lost. The stock could have gone down $20.00 too. I can't dwell on this one. Look forward not behind.

I still ended up ahead.

A few lessons:

1) Don't traffic in low volume stocks

2) Don't be in a hurry to sell for profits

3) Be patient

Monday, December 27, 2004

12/27/2004 - Scott Black

Hello, hope you all had a great Christmas for those who celebrate. I am pleased with my gifts. I received a few books that I had on my Amazon Wish List. I will have plenty to read for a couple months.

The Market has been pretty quiet for me. Today I decided to see what Scott Black has been up to. Scott runs Delphi Management out of Boston's Rowes Warf. Some of you may recognized Scott's name from Barron's round table. I read Barron's with a grain of salt. Some of these "superstar" analysts at the round table will make an incorrect prediction and then have the hubris not to even acknowledge their blooper the next time the "table" gathers. Don't get me started on Abbey Joseph Cohen.

I do like Scott Black. He is a Graham Dodd disciple, which is not a bad thing. Bottom line about Scott is that he is no dummy.

I am a little surprised to see that Scott's biggest holding is BERKSHIRE HATHAWAY CL B. Basically Scott has Warren Buffett managing some money. Moving on, Scott's fund sold Coke, before its slide (good move) and bought Pfizer, Pier One, Cypress Semiconductor. All value plays, which is no surprise. Pier One, is one of Berkshire's big holdings too.

The fourth quarter is almost over so we will revisit the 13F filings in January see what moves have been made. I don't advise "piggybacking" Scott. He will hold on to stock for years before it makes its move. I can't afford to tie money up for that long.

The Market has been pretty quiet for me. Today I decided to see what Scott Black has been up to. Scott runs Delphi Management out of Boston's Rowes Warf. Some of you may recognized Scott's name from Barron's round table. I read Barron's with a grain of salt. Some of these "superstar" analysts at the round table will make an incorrect prediction and then have the hubris not to even acknowledge their blooper the next time the "table" gathers. Don't get me started on Abbey Joseph Cohen.

I do like Scott Black. He is a Graham Dodd disciple, which is not a bad thing. Bottom line about Scott is that he is no dummy.

I am a little surprised to see that Scott's biggest holding is BERKSHIRE HATHAWAY CL B. Basically Scott has Warren Buffett managing some money. Moving on, Scott's fund sold Coke, before its slide (good move) and bought Pfizer, Pier One, Cypress Semiconductor. All value plays, which is no surprise. Pier One, is one of Berkshire's big holdings too.

The fourth quarter is almost over so we will revisit the 13F filings in January see what moves have been made. I don't advise "piggybacking" Scott. He will hold on to stock for years before it makes its move. I can't afford to tie money up for that long.

Friday, December 24, 2004

12/24/2004 - Merry Christmas!

Wishing you all a very Merry Christmas and a Happy New Year! I will be looking for some good investing ideas for 2005.

Cheers!

Jeff

Cheers!

Jeff

Thursday, December 23, 2004

12/23/2004 - Notes

I have been looking for ideas but have come up with nothing. I am tempted to wait until the New Year before making any new decisions. Why make more paperwork for the 2004 taxes? Really, I just can't come up with a good idea right now. So I am not going to do anything. Lets not force a trade. If a trade is not there don't go looking for entertainment in the Markets. I have learned that the hard way and I have to continually remind myself that is is OK to do nothing and stand aside.

Wednesday, December 22, 2004

12/22/2004 - I Want Coal for Xmas!

First, please let me know if you have any problems with my web page. I have been trying to make it easier to read.

OK, I have been looking for some ideas but can't really see anything going on out there. I have been thinking about one thing. Lets face it we are no longer in the "Internet Boom." That pretty obvious I know. We are however in an "Energy Boom." Energy stock IPOs have been coming off Wall Street with no great fanfare, which is how I like it. These boring little companies have been slowly moving north. Two companies in particular.

Enterprise Products Partners LP (EPD) and Foundation Coal Holdings Inc (FCL) are two recent IPOs that you could have bought below the offering price. EPD boasts a yield of 6.39% currently! These two stocks won't provide the excitement of an OSIP but then again I can do without that for now. I like these two companies not because of technical readings but because we are in an "Energy Boom" and I like the space they occupy.

I am going to keep on the lookout for more Energy related IPOs by big, well-known investment houses. It's not a sexy idea but if it makes me money, who cares?

OK, I have been looking for some ideas but can't really see anything going on out there. I have been thinking about one thing. Lets face it we are no longer in the "Internet Boom." That pretty obvious I know. We are however in an "Energy Boom." Energy stock IPOs have been coming off Wall Street with no great fanfare, which is how I like it. These boring little companies have been slowly moving north. Two companies in particular.

Enterprise Products Partners LP (EPD) and Foundation Coal Holdings Inc (FCL) are two recent IPOs that you could have bought below the offering price. EPD boasts a yield of 6.39% currently! These two stocks won't provide the excitement of an OSIP but then again I can do without that for now. I like these two companies not because of technical readings but because we are in an "Energy Boom" and I like the space they occupy.

I am going to keep on the lookout for more Energy related IPOs by big, well-known investment houses. It's not a sexy idea but if it makes me money, who cares?

Tuesday, December 21, 2004

What not to do.... A Tuesday Mourning QB

oops!

What a game! The Patriots finally made the front page of the Boston Globe (not the Red Sox). Too bad that the Pats had to lose to do so. You could see it happening in slow motion. One bad play here, a touch of "bad luck" there, a bad bounce over here, and there you have it. The Patriots lost their momentum and confidence. The Dolphins with 2 wins this season looked great. Anyone who did not follow that game would have guessed that the Patriots were 2-11 this season.

So why am I writing about this? Well, what can we learn from this Patriots loss? Here are a couple things:

1) Don't throw the ball when you don't have a target and your play is over.

2) Expect the unexpected.

3) You can't win all of them.

4) Realize when things are getting out of control. Stop and regroup.

Ron Borges, a writer for the Boston Globe, wrote it best.

"For one of the few times since Brady became New England's starting quarterback four years ago, he tried to do more than was wise. He tried to make a play when the wise thing would have been to cut his losses and live for the next one."

Sounds familiar. Huh?

Monday, December 20, 2004

12/20/2004 - Back to Work

Monday, and the Capital Markets are alive and well. I do not expect too much to go on this week. It should be quiet with the holidays and everything. I could be wrong.

My weekend was good. I did some holiday shopping and thought about the whole OSIP fiasco. An insidious issue it was. One thing I read over the weekend did give me some comfort though. I have been nibbling at Getting Started in Technical Analysis by Jack D. Schwager. I think it is a pretty good book. Basic, but helpful. Anyway, Schwager says that Druckenmiller was actually short the stock market before the 1987 "downdraft." He then changed his mind and went long the day before the crash! Can you believe it? Druckenmiller knew he was wrong and quickly changed his position, went short again and made some money. Who really knows what happened. I mean this guy was running big money. I thought it was hard to change directions that fast.

What did I get from this? Well, if you want to be in this business you have to expect uncertainty. You have to be disciplined and ready to move with the Market. Welcome aboard!

My weekend was good. I did some holiday shopping and thought about the whole OSIP fiasco. An insidious issue it was. One thing I read over the weekend did give me some comfort though. I have been nibbling at Getting Started in Technical Analysis by Jack D. Schwager. I think it is a pretty good book. Basic, but helpful. Anyway, Schwager says that Druckenmiller was actually short the stock market before the 1987 "downdraft." He then changed his mind and went long the day before the crash! Can you believe it? Druckenmiller knew he was wrong and quickly changed his position, went short again and made some money. Who really knows what happened. I mean this guy was running big money. I thought it was hard to change directions that fast.

What did I get from this? Well, if you want to be in this business you have to expect uncertainty. You have to be disciplined and ready to move with the Market. Welcome aboard!

Friday, December 17, 2004

12/17/2004 - OSIP UPDATE up 46%

You won't believe this one. Keep in mind that I sold OSIP yesterday. Well, I come into my office today, turn on the computer, check out my quotes and notice that OSIP is up $22.00. So it is trading around $69.00. My stomach fell about three feet. Needless to say I have a mix of feelings. The news that came out could have been bad, and the stock could have fell $22.00. So, you win some you lose some, but you keep on fighting.

What gets me is that this happened less than 24 hours after I sold. It is almost like a mean joke. So, I am not doing anything today. No matter what I do, I can't change what happened. I followed my plan and protected my capital. Time to move on. The fox is alive and well!

The day has ended and all is well. It is 4:38PM in Boston and I had the day to think about what happened. I just want to express what I was feeling because I almost did some stupid things. When I saw this event unfold today I wanted to stop time. I wanted to fix things so that I would win. These feelings are dangerous. They make you put on stupid trades, hoping for some kind of revenge. The best thing you can do is breath deeply and gather your compsure. Remind yourself that this is not a game for kicks and thrills. You can do serious damage if you are not careful. You have to live to fight another day.

What gets me is that this happened less than 24 hours after I sold. It is almost like a mean joke. So, I am not doing anything today. No matter what I do, I can't change what happened. I followed my plan and protected my capital. Time to move on. The fox is alive and well!

The day has ended and all is well. It is 4:38PM in Boston and I had the day to think about what happened. I just want to express what I was feeling because I almost did some stupid things. When I saw this event unfold today I wanted to stop time. I wanted to fix things so that I would win. These feelings are dangerous. They make you put on stupid trades, hoping for some kind of revenge. The best thing you can do is breath deeply and gather your compsure. Remind yourself that this is not a game for kicks and thrills. You can do serious damage if you are not careful. You have to live to fight another day.

Thursday, December 16, 2004

12/16/2004 - Stopped out of OSIP

Well, that was quick. I am out of OSIP. Sold at $47.53. As I said in my post last night, this stock trades on emotions and there is no floor here, (i.e. earnings, dividend, nada). So, I had a plan in place. I knew when to buy and I knew when to sell. I am out with a "businessman's loss." A calculated loss, if you will. I live to fight another day. Pretty glamorous, huh?

Wednesday, December 15, 2004

12/15/2004 - OSIP (BUY)

Well, some of my "groupies" have been wondering where I have been lately. I have been here, my hometown of Boston. I have been raking the Market for ideas and trying to figure out what to do next.

I have bought OSI pharmaceuticals. A drug/biotech company that has promising cancer drugs being developed. The stock has had a 52 week high of $98. and a low of about $28. The stock is trading at about $48. and change. I bought at $49.00.

Like all stocks, this stock moves on expectations. It has no earnings. It is trading on enthusiasm. So, don't let this one get away or it could be down in the 20s before you know it. I have a stop on at $47. but I may sell around $48. depending on the price action. Bank of Amerca has a price target of $75. So, hold on to your seats this could be a wild ride. Don't worry I have my finger on the seat ejection button.

I have bought OSI pharmaceuticals. A drug/biotech company that has promising cancer drugs being developed. The stock has had a 52 week high of $98. and a low of about $28. The stock is trading at about $48. and change. I bought at $49.00.

Like all stocks, this stock moves on expectations. It has no earnings. It is trading on enthusiasm. So, don't let this one get away or it could be down in the 20s before you know it. I have a stop on at $47. but I may sell around $48. depending on the price action. Bank of Amerca has a price target of $75. So, hold on to your seats this could be a wild ride. Don't worry I have my finger on the seat ejection button.

Friday, December 10, 2004

12/10/04 - Nuveen Senior Income Fund (NSL)

OK, I have been holding cash lately. Sold out of PIR the other day. I am getting hardly any interest for holding cash in my account. I came across an issue that pays about %6.34 a year, but pays interest on a monthly basis. Nuveen Senior Income Fund (NSL) is what I am talking about.

The fund is a non-diversified, closed-end management investment company. The fund's investment objective is to achieve a high level of current income, consistent with capital preservation. The Funds investment objective is a fundamental policy of the fund, meaning that it may be changed only by vote of a majority of the shareholders of the fund. The fund will invest primarily in adjustable rate U.S dollar-denominated secured Senior Loans.

Interest Rate Resets Can Mean More Stable Net Asset Value - Frequent rate resets will help eliminate much of the interest rate risk normally associated with fixed-income investing.

I know we all want to hit home runs, but there is nothing wrong with getting a few men on base either. I bought is at $9.22. I don't expect the price to move much (I hope).

The fund is a non-diversified, closed-end management investment company. The fund's investment objective is to achieve a high level of current income, consistent with capital preservation. The Funds investment objective is a fundamental policy of the fund, meaning that it may be changed only by vote of a majority of the shareholders of the fund. The fund will invest primarily in adjustable rate U.S dollar-denominated secured Senior Loans.

Interest Rate Resets Can Mean More Stable Net Asset Value - Frequent rate resets will help eliminate much of the interest rate risk normally associated with fixed-income investing.

I know we all want to hit home runs, but there is nothing wrong with getting a few men on base either. I bought is at $9.22. I don't expect the price to move much (I hope).

Tuesday, December 07, 2004

November Roundup

OK, November was a good month in general. The S&P 500 was up, I was up too, but not as much... I was up 3.44% the SP500 was up 7.14%. I am a little disappointed in the results but still hopeful. Oil/Energy stocks took a breather while Tech/Retail waxed.

You probably notice that things have been quiet here at Public Co$. Well, it is not that I have been sleeping. I just have not seen any good buying opportunities (for me). So, I will wait.

I still have EPD, PIR, which are looked at on a daily basis.

P.M. Notes

PIR - sold at $18.01

Why? A couple reasons: First, I bought the stock blindly after I read an article that Berkshire Hathaway bought a bunch. Not a good strategy. Secondly, the stock is in a trading range. Probably won't do much for a while. Lets hold the cash and wait.... Wait for a better opportunity with less risk.

You probably notice that things have been quiet here at Public Co$. Well, it is not that I have been sleeping. I just have not seen any good buying opportunities (for me). So, I will wait.

I still have EPD, PIR, which are looked at on a daily basis.

P.M. Notes

PIR - sold at $18.01

Why? A couple reasons: First, I bought the stock blindly after I read an article that Berkshire Hathaway bought a bunch. Not a good strategy. Secondly, the stock is in a trading range. Probably won't do much for a while. Lets hold the cash and wait.... Wait for a better opportunity with less risk.

Monday, November 29, 2004

Post Thanksgiving Thoughts....11/29/2004

I had a great Thanksgiving and I hope the same for you! I went to N.C. to visit my brother. We had a grand time. On the way I stopped at a hotel to rest. When I awoke, I did what comes naturally and turned on the TV. I got interested in a movie and had to watch the end. Searching for Bobby Fischer, came out in 1993. I wish I could find the screenplay online but no luck. I think the dialogue below is true for anyone who wishes to win. I recommend seeing the whole movie if you have not already!

Bruce: Do you know what it means to have "contempt" for your opponent?

Josh: No.

Bruce: It means to hate them. You have to hate them Josh, they hate you.

Josh: But I don't hate them.

Bruce: Well you'd better start.

AFL - I am reflecting on my AFL sale. I made a mistake. I looked at the news and not the stock action. Listen to the stock NOT the news. Should have held on...

Bruce: Do you know what it means to have "contempt" for your opponent?

Josh: No.

Bruce: It means to hate them. You have to hate them Josh, they hate you.

Josh: But I don't hate them.

Bruce: Well you'd better start.

AFL - I am reflecting on my AFL sale. I made a mistake. I looked at the news and not the stock action. Listen to the stock NOT the news. Should have held on...

Friday, November 19, 2004

11/19/2004 - Notes

It has been quiet for me on the investing front. I have not made any moves since my AFL sale. There have been some interesting opportunities out there but always missing one of my criteria (i.e. volume too low). Some good stocks rolling over too. To list a few: IBM, HD, AXP, BAC, C. Also, CL has moved south since my sell. B of A came out with a negative report saying there is a big restructuring charge on the horizon.

Still holding: PIR, EPD.

Still holding: PIR, EPD.

Monday, November 15, 2004

11/15/2004 - ???

A.M. NOTES

Well, AFL is up today for some reason. It was downgraded last Friday by Lehman, now the stock is up in early trading.

I think it is better to look at the end of day prices if you are in a swing trade. The hourly Market noise chop will turn you from using a daily chart to a day-trader. I think that is what I unconsciously did the other day. So, if you are making a buy decision based on a daily chart, you should make a sell decision based on a daily chart.

Well, AFL is up today for some reason. It was downgraded last Friday by Lehman, now the stock is up in early trading.

I think it is better to look at the end of day prices if you are in a swing trade. The hourly Market noise chop will turn you from using a daily chart to a day-trader. I think that is what I unconsciously did the other day. So, if you are making a buy decision based on a daily chart, you should make a sell decision based on a daily chart.

Friday, November 12, 2004

11/12/2004 AFL Downgraded by Lehman

AFL - Sold today, Lehman came out and downgraded the stock b/c of sales weakness. Got out with a small loss. I think it is better to stand aside and wait. No need to hold on to a stock with negative sentiment.

I mean, you want to keep your money moving forward, so to speak, like a football team's offense.

I mean, you want to keep your money moving forward, so to speak, like a football team's offense.

Thursday, November 11, 2004

Musings - Buy Sell or Hold?

I have become concerned that I may be selling positions too early. I don't have my thoughts formulated so I am going to put down my thoughts and try to make sense of them after.

1. Most likely you will not be able to sell at the exact top of trend.

2. You don't want to give away profits either hoping to get more.

3. You will get faked out of some positions.

4. You are trying to make money (against some very smart people and computers!).

5. Are you following your rules?

6. Go back and go over your plan!

I think it is important to remember that you cannot beat yourself up if you are making an effort to learn and fine tune your skills. Investing is not an easy task and there will be ups and downs. I think of what Gekko said to Bud Fox in the movie Wall Street:

GEKKO - "You're not as smart as I thought you were, Buddy boy, Listen hard -- don't count on Graham and Dodd to make you a fortune, everybody in the market knows the theory, ever wonder why fund managers can't beat the S&P 500? 'Cause they're sheep -- and the sheep get slaughtered. I been in the business since '69. Most of these high paid MBAs from Harvard never make it. You need a system, discipline, good people, no deal junkies, no toreadores, the deal flow burns most people out by 35. Give me PSHs -- poor, smart and hungry. And no feelings. You win some, you lose some but you keep on fighting, and if you need a friend, get a dog, it's trench warfare out there sport... (eyeing the surroundings) and in here too. I got twenty other brokers out there, analyzing Charts. I don't need another one. Talk to you sometime..."

P.M. NOTES

I guess I have to be more disciplined on my sells. I have to go over my plan and stick to it. I have to develop my sell discipline!!!

1. Most likely you will not be able to sell at the exact top of trend.

2. You don't want to give away profits either hoping to get more.

3. You will get faked out of some positions.

4. You are trying to make money (against some very smart people and computers!).

5. Are you following your rules?

6. Go back and go over your plan!

I think it is important to remember that you cannot beat yourself up if you are making an effort to learn and fine tune your skills. Investing is not an easy task and there will be ups and downs. I think of what Gekko said to Bud Fox in the movie Wall Street:

GEKKO - "You're not as smart as I thought you were, Buddy boy, Listen hard -- don't count on Graham and Dodd to make you a fortune, everybody in the market knows the theory, ever wonder why fund managers can't beat the S&P 500? 'Cause they're sheep -- and the sheep get slaughtered. I been in the business since '69. Most of these high paid MBAs from Harvard never make it. You need a system, discipline, good people, no deal junkies, no toreadores, the deal flow burns most people out by 35. Give me PSHs -- poor, smart and hungry. And no feelings. You win some, you lose some but you keep on fighting, and if you need a friend, get a dog, it's trench warfare out there sport... (eyeing the surroundings) and in here too. I got twenty other brokers out there, analyzing Charts. I don't need another one. Talk to you sometime..."

P.M. NOTES

I guess I have to be more disciplined on my sells. I have to go over my plan and stick to it. I have to develop my sell discipline!!!

Wednesday, November 10, 2004

11/10/2004 - Notes

It has been some time since my last update. I do have a few things that I would like to discuss.

1. I sold MYG a week back with a profit. If you go back and read my blog you see my reasons. What is wrong here? A large part of my trading principles are not based on feeling or what I think could happen. I sold MYG at a profit, which is great. However, MYG is up to $20.10 now. Obviously the market did not care what I thought. Don't tell the market what should happen. Listen to it and act within your plan.

2. CL - SOLD today 11/10/2004. My reason is that the stock is not acting with any force. I held the stock for 21 days and it went up a bit, now it is in a range. I got out with a good profit. I don't want to hold and trades that are in a range. They should be trending. After 21 days, I want that trend to take hold.

3. AFL - BOT 11/08/2004. This stock fit my criteria for the purchase. Lets let is ride and see where it takes us. Stops are in place. Looks like up trend in place.

1. I sold MYG a week back with a profit. If you go back and read my blog you see my reasons. What is wrong here? A large part of my trading principles are not based on feeling or what I think could happen. I sold MYG at a profit, which is great. However, MYG is up to $20.10 now. Obviously the market did not care what I thought. Don't tell the market what should happen. Listen to it and act within your plan.

2. CL - SOLD today 11/10/2004. My reason is that the stock is not acting with any force. I held the stock for 21 days and it went up a bit, now it is in a range. I got out with a good profit. I don't want to hold and trades that are in a range. They should be trending. After 21 days, I want that trend to take hold.

3. AFL - BOT 11/08/2004. This stock fit my criteria for the purchase. Lets let is ride and see where it takes us. Stops are in place. Looks like up trend in place.

Friday, November 05, 2004

11/05/2004 - Notes

What a bullish week we had! Viva Bush! Lets hope things continue this way for while.

CL - Stock had a pretty good week. The stock was oversold when I bought so it is coming back a little. The tricky part is selling. Like I said earlier, I want to see a 5 in the stock price. The market will tell me when to sell, so keeping listening. Give it some room to go.

EPD - Paid it nice dividend and is trending up! Keep listening.

PIR - Did nada today. Will be paying a div soon. I may dump this one. I bought it following what other investors are doing. Not a good strategy. I will look at it again on Monday.

CL - Stock had a pretty good week. The stock was oversold when I bought so it is coming back a little. The tricky part is selling. Like I said earlier, I want to see a 5 in the stock price. The market will tell me when to sell, so keeping listening. Give it some room to go.

EPD - Paid it nice dividend and is trending up! Keep listening.

PIR - Did nada today. Will be paying a div soon. I may dump this one. I bought it following what other investors are doing. Not a good strategy. I will look at it again on Monday.

Thursday, November 04, 2004

11/04/2004 - Notes

It has been some time since my last update. The Market was not really moving pre-election jitters. Since Bush won the election, the Market has done well. A nice change of pace for us investors. The month of October was OK for me. The S&P SPDRs returned 2.88% and I returned .085%. I attribute my anemic performance to Merck. I own it. If you are read the business section in the newspaper, you know what happened. Anyway, Merck is why I trailed the S&P 500. So, where do we stand now?

EPD - $23.96 - slight trend up.

PIR - $18.64 - slight trend up. Still in a range though.

CL - $46.52 - Too early to tell. Up but down by about the same in after hours. I want to see this stock reach the low 50s soon. That is my target now.

EPD - $23.96 - slight trend up.

PIR - $18.64 - slight trend up. Still in a range though.

CL - $46.52 - Too early to tell. Up but down by about the same in after hours. I want to see this stock reach the low 50s soon. That is my target now.

Friday, October 29, 2004

10/29/2004 - Notes

MYG - stock hit the $17.40 price mark. Sold at $17.37. A small profit. MYG is going through some problems, there debt is junk rated. This is not a stock that I want to hold on to for very long. Technically, it was oversold, so I bought. Fundamentally, the stock has a lot of work to do. I followed my plan and it work out.

Wednesday, October 27, 2004

10/27/2004 - Notes

MYG - stock has made a move up over the past couple of days. Usually the stock is strong in the afternoon. I like that since many institutions do much of their trading in the PM. If MYG shows weakness tmrw, stock is being sold. The company has a lot of problems to fix and I don't feel like holding on to a "fixer-upper" especially if I am not involved in the fixing. If the stock goes around $17.40, I am selling.

Monday, October 25, 2004

10/25/2004 - Notes

PIR - In range, small buying and selling. Not much going on here

EPD - In range, up today

CL - down today, I looked at the 1 min chart and there was some buying. I am not too concerned here. Stop is one so downside is limited.

MYG - I bought on technical advice. I am not going to hang around if this one goes south. Too much speculation here. Junk bond status. Stock was up today.

EPD - In range, up today

CL - down today, I looked at the 1 min chart and there was some buying. I am not too concerned here. Stop is one so downside is limited.

MYG - I bought on technical advice. I am not going to hang around if this one goes south. Too much speculation here. Junk bond status. Stock was up today.

Friday, October 22, 2004

10/22/2004 - Notes

CL - Down $0.15 in a narrow range. I have to give this stock some time to move.

EPD - Down $0.09, in range

PIR - Down $0.08, in range

MYG - looks interesting, will monitor on Monday.

EPD - Down $0.09, in range

PIR - Down $0.08, in range

MYG - looks interesting, will monitor on Monday.

Wednesday, October 20, 2004

10/20/2004 - Notes

Colgate-Palmoliv (CL) - This stock came out with OK news today. They are going to aggressively improve their marketing and did not adjust their earnings forecast downward. Institutions piled in today. I bought some at $45.35. Probably the high for the day. I have a stop in place so the downside is measured. The Company goes ex-div tmrw so the price my fall a bit. The Co also said they would buy back 20 mil shares. That should offer some downside support to the stock.

Tuesday, October 19, 2004

10/19/2004 - Notes

EPD - In a trading range.

PIR - $16.33 stop price. Down today but some big buying at the end of the day.

There was an interesting article in the WSJ last week. Peter Lynch had bought into a stock recently that "tanked." Some individuals piggybacked Lynch and bought too. However, this stock lost much of its value because of a scandal. So, some of the individuals are broke because they followed PL blindly. This should serve as a reminder that there is no easy way to make money in the capital markets. Think for yourself. You may be impressed with the results!

I am keeping an eye on a few individual stocks. There have been some sell offs but nothing moving up fast. Be patient, an opportunity will come.

PIR - $16.33 stop price. Down today but some big buying at the end of the day.

There was an interesting article in the WSJ last week. Peter Lynch had bought into a stock recently that "tanked." Some individuals piggybacked Lynch and bought too. However, this stock lost much of its value because of a scandal. So, some of the individuals are broke because they followed PL blindly. This should serve as a reminder that there is no easy way to make money in the capital markets. Think for yourself. You may be impressed with the results!

I am keeping an eye on a few individual stocks. There have been some sell offs but nothing moving up fast. Be patient, an opportunity will come.

Thursday, October 14, 2004

10/14/2004 - Notes

I do not have too much to talk about. The markets are going down right now, so there has not been much buying. My system seems to be doing its job. There have been no new purchases during this slide. LBY was bought due to some indicators and news. It did move up a bit. However, this stock has reversed and has headed south. I sold before the move and squeaked out a small gain.

I am keeping my eye on a few ideas but nothing is turning around yet. Stocks move up but it just seems to be noise. I don't see any huge breakouts. Satyam, is breaking out. You may recall that this stock was sold at $23.05 for a good profit. I had to sell given my objective and plan.

So, keep searching and sniffing out prey. We'll find some good eatins' soon....

I am keeping my eye on a few ideas but nothing is turning around yet. Stocks move up but it just seems to be noise. I don't see any huge breakouts. Satyam, is breaking out. You may recall that this stock was sold at $23.05 for a good profit. I had to sell given my objective and plan.

So, keep searching and sniffing out prey. We'll find some good eatins' soon....

Monday, October 11, 2004

10/11/200 - Notes

A.M. NOTES

I just finnished a book by Andy Kessler entitled, Running Money. It was a good read. I recommend it to anybody interested in the market and business. There were many ideas and stories that interested me in the book. One thought in particular stuck out. It is a long quote but important. So read...

"Those 'families with substantial assets' had wealth, but it wasn't static. Every generation it shrank unless they chased returns. No rest for the weary. But they don't like risk. Well, too bad. I think what I learned is that wealth comes not just from taking risk but from constantly taking risks."

So if you think you can buy Coke and Merck and go golfing everyday, think again. Making money is not that easy. You must develop a system, pay attention, and be disciplined to succeed. Also, you must think for yourself.

I just finnished a book by Andy Kessler entitled, Running Money. It was a good read. I recommend it to anybody interested in the market and business. There were many ideas and stories that interested me in the book. One thought in particular stuck out. It is a long quote but important. So read...

"Those 'families with substantial assets' had wealth, but it wasn't static. Every generation it shrank unless they chased returns. No rest for the weary. But they don't like risk. Well, too bad. I think what I learned is that wealth comes not just from taking risk but from constantly taking risks."

So if you think you can buy Coke and Merck and go golfing everyday, think again. Making money is not that easy. You must develop a system, pay attention, and be disciplined to succeed. Also, you must think for yourself.

Sunday, October 10, 2004

10/10/2004 - Notes

Sorry for not updating my journal as often as usual. I have been away. Now I am back and ready to get down to business.

EPD - This stock continues to show strength. You could take some profits now but I feel this stock should be held longer. You get 7% on your money while you wait. Not bad in today's interest rate environment. EPD has entered a new trading range. May take a while for the stock to digest its recent gains.

PIR - Still in trading range. Still waiting...

S&P 500 SPDRs month of Sept return for the S&P 500 Spiders was 0.0157. **Market Return - Morningstar calculates the market-price return by taking the change in the fund's market price, reinvesting all income and capital-gains distributions during the period, and dividing by the starting market price.

The return on my portfolio was 0.0275.

EPD - This stock continues to show strength. You could take some profits now but I feel this stock should be held longer. You get 7% on your money while you wait. Not bad in today's interest rate environment. EPD has entered a new trading range. May take a while for the stock to digest its recent gains.

PIR - Still in trading range. Still waiting...

S&P 500 SPDRs month of Sept return for the S&P 500 Spiders was 0.0157. **Market Return - Morningstar calculates the market-price return by taking the change in the fund's market price, reinvesting all income and capital-gains distributions during the period, and dividing by the starting market price.

The return on my portfolio was 0.0275.

Wednesday, October 06, 2004

10/6/2004 - Notes

P.M. NOTES

LBY - up today on almost double volume at 90K. Price up about $1.00. 20/20 hindsight is always great to have. The one thing that I did not do was give LBY some breathing room. I bought and had my stop but got scared for reasons mentioned in my previous post.

I don't see anything compelling right now. I am sure there is stuff out there but I can't see it. Still hunting though...

LBY - up today on almost double volume at 90K. Price up about $1.00. 20/20 hindsight is always great to have. The one thing that I did not do was give LBY some breathing room. I bought and had my stop but got scared for reasons mentioned in my previous post.

I don't see anything compelling right now. I am sure there is stuff out there but I can't see it. Still hunting though...

Tuesday, October 05, 2004

10/5/2004 - Notes

A.M. NOTES

Problems with Blogger yesterday. No updates…

EPD and PIR – still look healthy. PIR is in a trading range still. EPD is trending up but seems to have trouble closing in higher ground. This stock offers a lot of value given the 7% dividend.

LBY – had to sell this one at $19.37. A small profit. Why was it sold?

· This low volume stock is dangerous, slippage is large and one large institution could kill me if they decided to sell.

· Also, volume did not spike up the way you want to see it do so.

· Yesterday, the stock was up in the AM, and then sold off. Ended down for the day. Opened lower today. I figured the amateurs would at least buy this AM. That did not happen either.

· The trend as stalled or reversed.

· Had to sell and regroup.

Colgate is a stock that should be closely watched. They are going through some hard times but this is a set up for a trend up at some point in the future. Stay tuned…

Problems with Blogger yesterday. No updates…

EPD and PIR – still look healthy. PIR is in a trading range still. EPD is trending up but seems to have trouble closing in higher ground. This stock offers a lot of value given the 7% dividend.

LBY – had to sell this one at $19.37. A small profit. Why was it sold?

· This low volume stock is dangerous, slippage is large and one large institution could kill me if they decided to sell.

· Also, volume did not spike up the way you want to see it do so.

· Yesterday, the stock was up in the AM, and then sold off. Ended down for the day. Opened lower today. I figured the amateurs would at least buy this AM. That did not happen either.

· The trend as stalled or reversed.

· Had to sell and regroup.

Colgate is a stock that should be closely watched. They are going through some hard times but this is a set up for a trend up at some point in the future. Stay tuned…

Monday, October 04, 2004

10/04/2004 - Notes

P.M. NOTES

LBY - stock was up strong this AM then moved into neg territory. I have a stop in place so I know my max loss. I want to give this stock some breathing room but I have to be careful since it trades about 51K shares.

LBY - stock was up strong this AM then moved into neg territory. I have a stop in place so I know my max loss. I want to give this stock some breathing room but I have to be careful since it trades about 51K shares.

Friday, October 01, 2004

10/01/2004 - Notes

A.M. NOTES

EPD - stock still showing strength. All EMAs lines moving up.

PIR - Here again, this stock is in a trading range. No action or concern until this stock moves out of "normal" trading range. No one knows how long this will take.

P.M. NOTES

LBY - This is an interesting company. Supply tableware products in the United States, Canada and the Netherlands, and exports its products to 75 other countries. Technically this stock was over-sold. Bought at $18.99. Stop at $17.47. Company plans on selling its manufacturing unit in California and move to China and Europe.

Remind me to write about Bill Belichik and winning.

EPD - stock still showing strength. All EMAs lines moving up.

PIR - Here again, this stock is in a trading range. No action or concern until this stock moves out of "normal" trading range. No one knows how long this will take.

P.M. NOTES

LBY - This is an interesting company. Supply tableware products in the United States, Canada and the Netherlands, and exports its products to 75 other countries. Technically this stock was over-sold. Bought at $18.99. Stop at $17.47. Company plans on selling its manufacturing unit in California and move to China and Europe.

Remind me to write about Bill Belichik and winning.

Thursday, September 30, 2004

9/30/2004 - Notes

Today was an interesting day. I kinda thought it would be. I was on the golf course, which is about right. I was looking at some charts last night and noticed Libbey (LBY). The stock looks interesting and the chart looks even better. It was up $0.69 today. I will look for an entry point, maybe tmrw.

Merck took a beating today. Down about $12. Most likely this sell off was too much. Keep an eye on the stock, could move up to adjust.

Merck took a beating today. Down about $12. Most likely this sell off was too much. Keep an eye on the stock, could move up to adjust.

Wednesday, September 29, 2004

9/29/2004 - Notes

A.M. NOTES

PIR - in a trading range still, showing weakness.

EPD - trending up! Started out with a bang this morning but a large sell brought it back some. I have to figure out an exit strategy for this one. I don't want to get caught up in the market hype. Maybe put on a Parabolic SAR stop.

P.M. NOTES

Nothing to report. Tmrw is the last day of the month. We will be entering the infamous month of October for the Market. There are a few stocks out there that look interesting but nothing is screaming. Remember to be patient. The Market is not a place to play around. You can do serious damage to your account if you are careless or uninformed. Wait for the stock to come to you.

PIR - in a trading range still, showing weakness.

EPD - trending up! Started out with a bang this morning but a large sell brought it back some. I have to figure out an exit strategy for this one. I don't want to get caught up in the market hype. Maybe put on a Parabolic SAR stop.

P.M. NOTES

Nothing to report. Tmrw is the last day of the month. We will be entering the infamous month of October for the Market. There are a few stocks out there that look interesting but nothing is screaming. Remember to be patient. The Market is not a place to play around. You can do serious damage to your account if you are careless or uninformed. Wait for the stock to come to you.

Tuesday, September 28, 2004

9/28/2004 - Notes

A.M. NOTES

Nothing to add about the market. I will be adding a triple screen system to my methodology. The triple screen system basically says that you can only trade in the direction of the weekly charts. Use the daily/hourly charts for your entry.

My methodology is set now. I don't want to keep fiddling around with it. You can turn a good system in a crappy one by trying to make it "perfect." No system will be perfect. Good money management is essential due to the imperfections of a system. Lastly, you need discipline.

In summary:

1) good system

2) tight money management

3) discipline

P.M. NOTES

EPD - still moving up. Not much overhead resistance here and there ia a 7% div. Let this one run.

PIR- down today at $17.85. stop is at $16.33.

Nothing to add about the market. I will be adding a triple screen system to my methodology. The triple screen system basically says that you can only trade in the direction of the weekly charts. Use the daily/hourly charts for your entry.

My methodology is set now. I don't want to keep fiddling around with it. You can turn a good system in a crappy one by trying to make it "perfect." No system will be perfect. Good money management is essential due to the imperfections of a system. Lastly, you need discipline.

In summary:

1) good system

2) tight money management

3) discipline

P.M. NOTES

EPD - still moving up. Not much overhead resistance here and there ia a 7% div. Let this one run.

PIR- down today at $17.85. stop is at $16.33.

Monday, September 27, 2004

9/27/2004 - Notes

A.M. NOTES

Looks like the market is heading lower this morning. Nothing to add now. Keeping an eye on all stops (PIR & EPD). Also looking at potential ideas (CL, KO, MO).

P.M. NOTES

EPD - stock is trending higher. One of those quiet stocks that seems to move up steadily each week. If this stock continues to perform this way it may be wise to put on a Parabolic SAR stop. Too early to tell.

PIR - down today. Definitely showing weakness for the past week. If the stock moves below its trading range the protective stops will be tightened.

Looks like the market is heading lower this morning. Nothing to add now. Keeping an eye on all stops (PIR & EPD). Also looking at potential ideas (CL, KO, MO).

P.M. NOTES

EPD - stock is trending higher. One of those quiet stocks that seems to move up steadily each week. If this stock continues to perform this way it may be wise to put on a Parabolic SAR stop. Too early to tell.

PIR - down today. Definitely showing weakness for the past week. If the stock moves below its trading range the protective stops will be tightened.

Friday, September 24, 2004

9/24/2004 - Notes

A.M. NOTES

Nothing to add. Keeping an eye on all holdings.

P.M. NOTES

EPD - On the daily chart EPD is in a strong uptrend. On the weekly, this stock is just starting to show strength. Volume is increasing too. Bulls appear to be in charge. Hold.

PIR - Showing some weakness on both daily and weekly charts. Looks like some instituions are stepping in to add support on downturns. Hold.

Nothing to add. Keeping an eye on all holdings.

P.M. NOTES

EPD - On the daily chart EPD is in a strong uptrend. On the weekly, this stock is just starting to show strength. Volume is increasing too. Bulls appear to be in charge. Hold.

PIR - Showing some weakness on both daily and weekly charts. Looks like some instituions are stepping in to add support on downturns. Hold.

Thursday, September 23, 2004

9/23/2004 - Notes

A.M. NOTES

SAY - stopped out, no longer holding

EPD - still waiting

PIR - Still waiting

P.M. NOTES

PIR - stop is at $16.33. Trading range $17.00 to $18.60. The EMAs are flat or trending up.

EPD - stop is at $18.67. Trading range $22.00 to $22.50. The EMAs are flat or trending up too.

OK, like I said in the AM NOTES, I am still waiting for EPD and PIR to trend up. Don't forget that EPD has a div. yield of About 7%.

advice: hold tight..

SAY - stopped out, no longer holding

EPD - still waiting

PIR - Still waiting

P.M. NOTES

PIR - stop is at $16.33. Trading range $17.00 to $18.60. The EMAs are flat or trending up.

EPD - stop is at $18.67. Trading range $22.00 to $22.50. The EMAs are flat or trending up too.

OK, like I said in the AM NOTES, I am still waiting for EPD and PIR to trend up. Don't forget that EPD has a div. yield of About 7%.

advice: hold tight..

a story about foxes

Someone asked me what the Market was going to do the other day.

I replied, "I don't know. I am not smart enough to predict the Market. I just follow where the group is going."

The person said to me, "Oh, so you are a sheep!?"

I was a little taken aback by the comment but said, "Yeah, I guess."

Later in the day I was thinking about my dialogue with the person and became concerned. Hey, I don't want to be a sheep, they usually get slaughtered at the end of the story. No? Also, that is not really my whole investing philosophy. True, I follow the trend. I don't decide what or when or how long the trend will last. I get in and get out. My number one priority is DON"T GET SLAUGHTERED!

So, if I could go back to the conversation that I was having with the person, I would say, "Well, I may look like a sheep but I am not one. Come here and take a closer look. See my teeth. See the blood stains? Feel my fur. Its not wooly. Is it? I am actually a fox disguised as a sheep. Pretty sneaky huh?"

I would like to make a change to the old Wall Street adage about Bulls, Bears, Sheep and Pigs. Lets add Foxes to the group, but don't tell anyone...

As ever,

JWK

After some thought, lets cut the BS. If I am going into the capital markets, I would rather be a shark. They are quick, efficient and kill their prey.

I replied, "I don't know. I am not smart enough to predict the Market. I just follow where the group is going."

The person said to me, "Oh, so you are a sheep!?"

I was a little taken aback by the comment but said, "Yeah, I guess."

Later in the day I was thinking about my dialogue with the person and became concerned. Hey, I don't want to be a sheep, they usually get slaughtered at the end of the story. No? Also, that is not really my whole investing philosophy. True, I follow the trend. I don't decide what or when or how long the trend will last. I get in and get out. My number one priority is DON"T GET SLAUGHTERED!

So, if I could go back to the conversation that I was having with the person, I would say, "Well, I may look like a sheep but I am not one. Come here and take a closer look. See my teeth. See the blood stains? Feel my fur. Its not wooly. Is it? I am actually a fox disguised as a sheep. Pretty sneaky huh?"

I would like to make a change to the old Wall Street adage about Bulls, Bears, Sheep and Pigs. Lets add Foxes to the group, but don't tell anyone...

As ever,

JWK

After some thought, lets cut the BS. If I am going into the capital markets, I would rather be a shark. They are quick, efficient and kill their prey.

Wednesday, September 22, 2004

SAY (NYSE) 9/22/2004 Sold $23.05

9/22/2004 - Notes

A.M. NOTES

SAY - Stop is set to $23.05 today. Whole market is off this morning.

P.M. NOTES

SAY - Well, I got stopped out of SAY today at $23.05 using the Parabolic SAR stop. The stock had a pretty good run up over the last few weeks. I was surprised that SAY moved as hard as it did today. All indicators turned down. I am always concerned that I may have left some money on the table but there is no getting around that feeling in this business. In order to keep alive in this business you need your capital. Mission accomplished.

SAY - Stop is set to $23.05 today. Whole market is off this morning.

P.M. NOTES

SAY - Well, I got stopped out of SAY today at $23.05 using the Parabolic SAR stop. The stock had a pretty good run up over the last few weeks. I was surprised that SAY moved as hard as it did today. All indicators turned down. I am always concerned that I may have left some money on the table but there is no getting around that feeling in this business. In order to keep alive in this business you need your capital. Mission accomplished.

Tuesday, September 21, 2004

9/21/2004 - Notes

A.M. NOTES

SAY - The stock was up yesterday, the stock came out of the gates fast this AM too. The Parabolic stop has been moved up to $22.89. The activity this morning looked like institutions buying in some huge blocks. The volume charts looked impressive.

P.M. NOTES

The MACD is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. Signals are taken when MACD crosses its signal line, calculated as a 9 day exponential moving average of MACD.

The indicator is primarily used to trade trends and should not be used in a ranging market.

First check whether price is trending. If MACD is flat or stays close to the zero line, the market is ranging and signals are unreliable.

Signals are far stronger if there is a large swing above or below the zero line. Flat MACD signals that the market is ranging - we are more likely to be whipsawed in/out of our position.

SAY - up today +$0.52. Day started off strong and then pulled back a bit. EMA all trending up. Stock had some selling pressure at the end of the day. The stop will be adjusted tomorrow.

SAY - The stock was up yesterday, the stock came out of the gates fast this AM too. The Parabolic stop has been moved up to $22.89. The activity this morning looked like institutions buying in some huge blocks. The volume charts looked impressive.

P.M. NOTES

The MACD is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. Signals are taken when MACD crosses its signal line, calculated as a 9 day exponential moving average of MACD.

The indicator is primarily used to trade trends and should not be used in a ranging market.

First check whether price is trending. If MACD is flat or stays close to the zero line, the market is ranging and signals are unreliable.

Signals are far stronger if there is a large swing above or below the zero line. Flat MACD signals that the market is ranging - we are more likely to be whipsawed in/out of our position.

SAY - up today +$0.52. Day started off strong and then pulled back a bit. EMA all trending up. Stock had some selling pressure at the end of the day. The stop will be adjusted tomorrow.

Monday, September 20, 2004

9/20/2004 - Notes

A.M. NOTES

Today, I am keeping a close eye on SAY. The Parabolic SAR will be adjusted again. The stop price is moved up to $22.52. Stay tuned...

P.M. NOTES

PIR - stock is in a trading range of ~ $16.90 - $18.73, 20 and 50 Day EMA are trending up, current price is $18.62. Keep holding PIR, this was a Buffett idea so keep long-term prospective.

EPD - stock is in a trading range of ~ $22.03 - $22.40, 20-50-200 Day EMA all trending up. Volume trending up too. This stock also boasts a 6.71% Div yield. Continue holding this stock for long term appreciation.

SAY - up today so the stop was not used. There are some institutions taking some profits, causing some selling pressure. Bulls are still winning the battle though. The stop will be put on tomorrow.

Today, I am keeping a close eye on SAY. The Parabolic SAR will be adjusted again. The stop price is moved up to $22.52. Stay tuned...

P.M. NOTES

PIR - stock is in a trading range of ~ $16.90 - $18.73, 20 and 50 Day EMA are trending up, current price is $18.62. Keep holding PIR, this was a Buffett idea so keep long-term prospective.

EPD - stock is in a trading range of ~ $22.03 - $22.40, 20-50-200 Day EMA all trending up. Volume trending up too. This stock also boasts a 6.71% Div yield. Continue holding this stock for long term appreciation.

SAY - up today so the stop was not used. There are some institutions taking some profits, causing some selling pressure. Bulls are still winning the battle though. The stop will be put on tomorrow.

Football vs. Trading

Bill Belichik

You probably don't think this posting has anything to do with trading but give me a chance. During a football game, generally each team is just trying to get to their first down. Nothing fancy, maybe some short passes or using the running back. However, every once in a while you see the QB make a huge play and an exciting play turns into a touchdown. I see many similarities between football and trading.

1). Don't lose your field position.

2). Don't force any fancy play that could risk the game.

3). Move the ball forward.

4). Secure the win.

I know this is a crude analysis but valid nonetheless.

Saturday, September 18, 2004

9/18/2004 - Market Thoughts

Satyam has started to make its move, although the stock was down $0.83 on Friday. I don't think the move down is anything to worry about. Yet. The Parabolic SAR stop will still be put on next week. The ADX shows strength but the +D line is moving down. So we will keep an eye on that signal. Otherwise all systems go.

I am keeping an eye on Coke and Dean Foods. These companies have been sold off pretty good. I will check their action on Monday to see where we stand.

I am keeping an eye on Coke and Dean Foods. These companies have been sold off pretty good. I will check their action on Monday to see where we stand.

Thursday, September 16, 2004

SAY (NYSE) update

SAY (NYSE) 9/16/2004

Hello friends, as usual it has been a while since I last published. I have been looking at SAY and this stock is in a confirmed uptrend which started around Sept 1. We have been waiting for this to happen for quite sometime. Lets review some of the technical indicators:

RSI (14) is at 77.0. The RSI compares the magnitude of a stock's recent gains to the magnitude of its recent losses and turns that information into a number that ranges from 0 to 100. It takes a single parameter, the number of time periods to use in the calculation. Generally, if the RSI rises above 30 it is considered bullish for the underlying stock. Conversely, if the RSI falls below 70, it is a bearish signal. Some traders identify the long-term trend and then use extreme readings for entry points. If the long-term trend is bullish, then oversold readings could mark potential entry points.

ADX (14) is at 39.1. In looking at the chart you can see that the SAY is in a trend and the trend is STRONG.

ADX is an oscillator that fluctuates between 0 and 100. Even though the scale is from 0 to 100, readings above 60 are relatively rare. Low readings, below 20, indicate a weak trend and high readings, above 40, indicate a strong trend. The indicator does not grade the trend as bullish or bearish, but merely assesses the strength of the current trend. A reading above 40 can indicate a strong downtrend as well as a strong uptrend. +DI measures the force of the up moves and -DI measures the force of the down moves over a set period.

ADX can also be used to identify potential changes in a market from trending to non-trending. When ADX begins to strengthen from below 20 and/or moves above 20, it is a sign that the trading range is ending and a trend could be developing.

As a simple rule of thumb, "When the +DI line is above the -DI line, all Parabolic sell signals can be ignored."

OK, SAY is in a confirmed strong uptrend. Thus, I feel good about putting on a Parabolic SAR stop. The stop is place at $21.55. 9/16/2004 This stop will be adjusted each day.

Parabolic SAR stop at $22.08. 9/17/2004

Wednesday, September 08, 2004

Where are we?

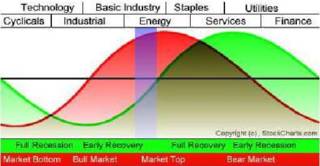

Date: 9/08/2004

I am always curious where we are in the Market. I took this from StockCharts.com. I hope I don't get in trouble. Based on Sam Stovall's S&P Guide to Sector Rotation, we are at the top of the Market cycle. I am not selling all my holdings just yet. My gut instinct is that the Middle East and Venezuela problems have had much to do with the increase in energy stocks. I am sure you have figured that out too. I took a look at the Dow Avg. stocks today and I don't see any huge steals out there (based on technicals), maybe INTC.

Tuesday, September 07, 2004

MEMC Electronics - I got killed...

MEMC Electronic (WFR - NYSE)

It has been awhile since my last journal entry. I try not to write when I don’t have anything to say. I guess that is good and bad. Good because I will not waste your time. It is bad because I should have commentary about the Market that does not waste your time. Something to work on I guess…

Let me first say that PIR and EPD have done well thus far. PIR is up about 2% and EPD is up about 10% from the buy price. There is one stock, however, that I bought a while back that has not done well. MEMC Electronic (WFR) was bought after reading a favorable article in Barron’s magazine. Scott Black, a very smart guy, who runs Delphi Management in Boston, loaded up on this stock himself. I have made thousands of dollars on Scott’s advice. Not this time. I took a 26% haircut. I did not follow the 8% rule.

MEMC Electronic Materials, Inc. is engaged in the production of wafers for the semiconductor industry. The Company provides wafers in sizes ranging from 100 millimeters to 300 millimeters and in three categories: prime polished, a highly refined, pure wafer with an ultra-flat and ultra-clean surface; epitaxial, a think, silicon layer grown on the polished surface of the wafer and test/monitor, which is substantially the same as a prime polished wafer, but with some less rigorous specifications. The Company's wafers are used as a starting material for the manufacture of various types of semiconductor devices, including microprocessor, memory, logic and power devices. In turn, these semiconductor devices are used in computers, cellular phones and other mobile electronic devices, automobiles and other products. Its principal customers are semiconductor device manufacturers, including memory, microprocessor and applications specific integrated circuit manufacturers, as well as foundries.

It did not help that the Semiconductor Equipment Industry is ranked last in terms of performance. I know EMEC will come back. I don’t know when or the magnitude.

I bought WFR around $10. The stock pierced the 200 MA and I held on. The stock pierced the 50 MA and I held on. So, now I finally decide to sell. I have to study this chart so I don’t make the same mistake twice!

Tuesday, August 24, 2004

Pier 1 Imports (PIR) NYSE

Pier 1 Imports (PIR) NYSE Purchased on 8/24/2004 at $17.75

OK, this was not my idea but I like nonetheless. I came across this company after reading about two investors who have been loading up on the company. Warren E. Buffett and Scott Black have loaded up on this stock. After looking at PIR and comparing the company to its peers, I can see why the value is so compelling.

---------------------Market Cap------ P/E------------- ROE %----- Div. Yield %----- Debt to Equity------ Price to Book

Retail (Specialty) ------212.50B-------- 41.609---- 14.703------- 1.196-------------- 0.514--------------- 5.782

Pier 1 Imports, Inc. ------1.54B--------- 14.551---- 16.777------- 2.266------------- 0.028---------------- 2.3

Analysts have a 2005 EPS estimate between $1.18 and $1.42 with an avg. of $1.33. A simple calculation puts PIR at about $50 a share based on the industry avg. I know that sounds simple but is a valid metric. True, PIR has to beef up there top line growth rate but they are certainly making an effort.

"Despite record sales of nearly $1.9 billion, the specialty retailer saw its per-share earnings slip 5% in the fiscal year that ended in February. As a result, Pier 1 Chairman and CEO Marvin Girouard says, "we will be evaluating all aspects of the company" -- from its merchandising practices to its advertising and marketing programs. " from the Dallas Business Journal

There is definitely value here. The question is whether management can right the ship and grow the earnings multiple. Stay tuned...

Saturday, August 21, 2004

Enterprise Prod. Part. (EPD) NYSE

Enterprise Product Partners (EPD) NYSE - Purchased on 8/5/04 for $20.29.

Enterprise Products Partners L.P. (Enterprise) is a midstream energy company serving producers and consumers of natural gas and natural gas liquids (NGLs). The Company conducts all of its business through its wholly owned subsidiary, Enterprise Products Operating L.P. and its subsidiaries and joint ventures. The Company has five business segments: Pipelines, Fractionation, Processing, Octane Enhancement and Other. Pipelines consists of NGL, petrochemical and natural gas pipeline systems, storage and import/export terminal services. Fractionation primarily includes NGL fractionation, isomerization and propylene fractionation. Processing includes Enterprise's natural gas processing business and related NGL marketing activities. Octane Enhancement represents the Company's investment in a facility that produces motor gasoline additives to enhance octane. The Other business segment consists of fee-based marketing services and various operational support activities.

Most people buy MLPs for the yield and long term prospects. MLPs aren't good trading vehicles becuase they aren't very volatile and because of their high dividends/distributions it's very expensive to maintain a short position.

Sunday, August 15, 2004

Where are we in the current economic cycle?

Steel and oil stocks are the leaders in this current market. Can we assume that we are at a certain point in the current economic expansion because these two industries are waxing? It is more complicated than that. Oil is being impacted by the conflict in the Middle East (and Venezuela perhaps). China is also creating a large demand for oil, which is a somewhat new factor. Oil producing countries are always turning their spigots off and on. They manually create the supply, demand is going up though. So I think we should expect to see higher oil prices in the future. If oil hits $60. A barrel, the US could go into recession.

Steel stocks. Why are steel stocks leading the market? The domestic steel market is being affected by six factors.

Steel stocks. Why are steel stocks leading the market? The domestic steel market is being affected by six factors.

- An exponential increase in steel production in.... You guessed it. China.

- The overall improvement in the US economy and in manufacturing.

- Raw materials in steelmaking. Coal, coke, scrap, iron ore and certain alloys. Raw material costs have skyrocketed to the point where the steel producers must increase base prices.

- Coal supply has being impacted by two fires. One in West Virginia and one in China.

- The energy costs that it takes to make steel have increased.

- Shipping costs have increased.

Friday, August 13, 2004

Has the bloodletting stopped?

The last couple of days have been hard to endure, if you are invested in equities. The price of oil and the weak job growth in July has spooked investors. Oil is at $45 a barrel. I predict that oil continues to rise until the election. If the Middle East can keep oil prices high, the US economy will drag, the Market will continue its sell off. This in turn could ruin President Bush's re-election. Just an idea. Venezuela is a wild card as well. Who knows what will happen there and the country's oil production after Sunday's recall vote.

Thursday, August 12, 2004

What to invest in?

In thinking about this diary, I have become cognizant of my own investing styles and techniques. Great! This is a positive thing for me. I think too many people take a pell-mell approach to investing. One day they like gold; the next day they like equities. They have no conviction in what they bought or a sound exit strategy. I have made this mistake myself. I still do.

So the question is, where do you put your hard earned dollars? Where do we start?

1) We need an investing strategy

2) We need an exit strategy

3) We need investments

So the question is, where do you put your hard earned dollars? Where do we start?

1) We need an investing strategy

2) We need an exit strategy

3) We need investments

Wednesday, August 11, 2004

WELCOME

Welcome to my blog about investing and the economy. Let me introduce myself. I am not a professional investor. However, I do take investing seriously and I have been successful in making money in the stock market. I have had some losses too! On whole, I am up.

I have an MBA from a school in Boston. I sell real estate in Boston. Before real estate, I was a financial analyst for a consulting company based in Boston. My job for the consulting company was good and safe. I just felt caged. I had to leave for my own good.

So, what is this blog about? Well, it will probably change from time to time but the basic idea will be simple.

1) Discuss investing ideas

2) Discuss business topics

3) Make money in the capital markets

Thank you for joining me. I look forward to sharing this "real time" stock idea diary with you!

I have an MBA from a school in Boston. I sell real estate in Boston. Before real estate, I was a financial analyst for a consulting company based in Boston. My job for the consulting company was good and safe. I just felt caged. I had to leave for my own good.

So, what is this blog about? Well, it will probably change from time to time but the basic idea will be simple.

1) Discuss investing ideas

2) Discuss business topics

3) Make money in the capital markets

Thank you for joining me. I look forward to sharing this "real time" stock idea diary with you!

Subscribe to:

Posts (Atom)